- Yachting for beginners

- Owning a yacht

- Motor Yachts

- Sailing Yacht

- Indian Ocean

- Mediterranean

- Buying or Selling a Yacht

- Yachting Events

- FAQ – Luxury Yacht Charter

- FAQ – Buying a Yacht

- FAQ – Sell your Yacht

- How Much Does It Cost To Charter A Luxury Yacht?

- All our Blog Post & News

Yacht Insurance: The Definitive Owner’s Guide

A sailing vessel’s indemnification liability coverage is provided through yacht insurance, and it covers any damage to the yacht’s body, property destruction of others, and private property damage aboard the vessel. This insurance may also cover gas supply, towing, and help if your boat gets stuck, depending on the insurance company.

Understanding The Two Parts of Yacht Insurance

Hull insurance.

Hull insurance is a direct and all-risk insurance policy that covers damage and includes an agreed amount of hull insurance. The amount settlement is done when the policy is drawn up, and the payment is in full in the event of a total loss. In addition, there’s the possibility of replacement costs insurance for partial losses. Still, sails, batteries, canvas outboards, and sometimes outdrives aren’t covered and are instead at risk of depreciation.

Indemnity and protection (P&I)

Protection and indemnity (P&I) insurance provides the most comprehensive insurance coverages for liability. Because maritime law is unique, you must have coverages specifically designed to protect you from risk-taking situations. P&I will cover any judgments against you and pay to defend you in admiralty courts.

What are the factors that can influence your yacht insurance?

Insurers consider many factors when deciding whether to offer a policy.

Almost any vessel can be insured – for a price. You should consider the following to make sure the policy you buy meets your needs:

- Age of the vessel

- Value (make sure you consider depreciation over the years of the value of your yacht)

- Speed/Power

- Type of vessel (Sailing, motor, Inboard, Outboard, utility, cruiser, offshore fishing boat)

- Custom built (boats without serial numbers can be tricky to insure)

- Location of use (which ocean are you planning to locate your boat. Make sure you let your insurance know whenever this changes over the months!)

What does yacht insurance usually cover?

Usually, the yacht insurance covers:

Liability protection: the bare minimum insurance

Property damage liability pays for damage to another person’s property caused by the accident you commit. You are covered if your yacht causes damage to individuals or damages other ships, docks, or buildings. Remember that harm or damage might occur due to direct contact with your boat or events induced by your yacht, such as during heavy wakes. In most cases, boat liability insurance covers you against covered claims and litigation involving settlements and legal expenses. To ensure that you have the right coverage, talk to your advisor regarding your needs and potential dangers.

Hull and machinery coverage

Hull insurance will cover any physical injury to your boat, including motors, trailers and equipment, and even accessories in many instances. Damage from wind and fire are typical claim types.

Uninsured boater coverage

Indemnifies bodily injured passengers of the insured watercraft who suffer injuries due to the uninsured owner of a different vessel.

Search and rescue

The maximum amount is $10,000 for costs that an insured incurs to a government entity like the United States Coast Guard (USCG), which provides emergency assistance and is covered at absolutely no cost.

Marine environmental damage and pollution coverage

This protection is available up to $10,000 in penalties and fines in the event of marine environmental damage as per the policy’s conditions. This coverage is added to the insurance company’s liability and OPA limit.

Agreed value coverage or actual cash value coverage

A cash value policy offers lower coverage than an agreed value insurance policy, however, generally with a lower cost. ACV policies provide coverage up to the value of the vessel. ACV policy would protect up to the price of the market for the boat if there was a complete loss, including depreciation and conditions of the vessel when it suffered the loss.

Crew medical and personal coverage

Reasonable medical and related costs are covered for all onboard passengers leaving or boarding the vessel. These benefits are granted per person instead of per event.

If your vessel gets damaged by accident, collision insurance is an optional insurance policy that covers the cost of fixing and replacing the damaged part with less deductible.

Sinking and wreck removal

Insurance for boats generally can cover sinking. However, there are some critical policy limitations. In general, insurance for boats should protect your boat if it sinks due to any covered risk. The policy could reimburse you for the cost of salvage or removal.

What is usually excluded from yacht insurance policies or comes as an extra?

War coverage

Damages caused by acts of war can turn out to be too great to insure, making the repayment too astronomical to be true.

Hurricane insurance

Your boat insurance provider may be able to pay for damages to your vessel caused by wind and hail from a storm in the event of a hurricane unless stated explicitly in the policy. Contact your boat insurance provider to find out what coverage you have during a storm.

Marine life encounters

Most insurance for boats doesn’t provide coverage for marine-related damage such as sharks, whales, and many other species. If you frequently sail in water full of marine creatures, it is possible to discuss a supplemental insurance policy with your insurance provider.

Insects and mold

The majority of yacht insurance policies do not cover insects and mold. It is essential to take the necessary steps to safeguard yourself against any pests on your vessel. So, this means that you must wash, drain, and dry your boat’s equipment after use.

Toys and PWC onboard

The PWC onboard may need to have a separate insurance policy as it is an expensive purchase.

Negligence or criminal acts

No insurance company is accountable for paying for the illegal actions of other people. Damage or loss due to reckless negligence and incompetence is also not acceptable.

Most insurance coverage for boats won’t cover certain events, such as racing on a yacht. Suppose you plan to use your boat to compete. In that case, you might want to consult your insurance representative about supplemental insurance, precisely the possibility of additional liability insurance if there’s a crash in the course.

Kidnapping and ransom

Because of the high stakes involved – human life and assets such as vessels and cargo — as well as the criminal character and challenging legal context, resolving a hijacking or abduction for ransom is a difficult task. Hence, kidnapping and ransom are not included in yacht insurance.

What do you need to know before picking a yacht insurance policy?

When evaluating physical damage cover, the most significant question is whether the insurance is focused on “agreed value” or “actual cash value” damage payout. If there is a complete loss, most agreed value coverage covers the amount shown on the insurance contract. After depreciation, you will receive compensation.

The actual cash value coverage offers protection up to the vessel’s present market worth at the moment of complete loss, after depreciation and the deductibles.

Although the coverage is smaller in an actual cash value insurance than in agreed value insurance, the policy is generally inexpensive.

The next thing you want to consider while choosing your insurance is the deductible and premium.

The amount you self-insure in the case of a loss is your yacht insurance deductibles. Put another way, it is the amount you spend on claims before your insurance comes in.

The next is premium. Choose insurance that can fit your budget to pay your premium on time without fail.

Another thing to consider is the Intended cruising area. Some policies put restrictions or have a defined area while cruising. So, choose an insurance policy that suits your cruising area so that in case of mishaps, you can get coverage.

Yacht Insurance Requirements

Is yacht insurance mandatory?

While it’s not usually a legal necessity, it is always a good idea. It’s unlikely to cost much, but it might save you a lot of money in a disaster. Even if you or your captain are the finest sailor on the planet, you must consider what would happen if someone else collides with your yacht.

Changing weather may damage your boat, yet you usually have little control over it. Fortunately, most yacht insurance policies aren’t too costly, and the modest additional cost may provide comfort while cruising on the sea.

Does the bank require insurance while you finance the yacht?

Yes, your bank may require proof of yacht insurance if you want to finance the yacht.

Do ports and marinas need your yacht insurance?

For utilizing their facilities, numerous ports and marinas will need you to have boat insurance.

Does renting the yacht require insurance?

If you intend to rent out your yacht, you must have coverage to safeguard your asset, and yacht insurance can be highly beneficial. If you want to rent your yacht, you must get boat insurance to protect yourself from liability hazards, and the insurance covers the majority of liability concerns.

Read also : The yacht charter experience ladder

How much does a yacht insurance cost?

Usually, yacht insurance costs between 1% and 5% percent of the yacht’s value. For instance, you may spend around $2,500 annually to insure a boat worth $100,000.

However, similar to other types of insurance, the cost of your boat insurance depends on you and your vessel. The higher the value of a boat, the greater the insurance cost. Yacht insurance is often costlier than floating insurance since yachts are more expensive. High-powered boats are riskier. Thus, insurance companies consider the kind of engine (inboard or outboard, amount of horsepower, and so on).

How can I lower my yacht insurance cost?

Here are a few steps that you can take to lower your insurance cost.

Limit the cruising area of your yacht

There are navigational restrictions in marine rules, meaning you may only sail inside a specified region. The premiums will be less the smaller and securer the area is.

Have good training and driving records

Insurance companies are interested in your expertise on the water. The completion of a boating course demonstrates proficiency, which reduces your risk. Most insurance companies would consider boating lessons, but they may even provide a rate reduction. Contact your agent to determine whether safety-related boating classes impact your premium rates.

Lower the liability limits

Most insurance companies will require your credit score to establish suitable premiums. Maintaining a good credit score has several advantages, including cheaper insurance prices. To lower your liability limits, consider working on your credit score.

Pick a higher deductible to reduce the premium of your insurance

A greater deductible implies that the policyholder will be responsible for a percentage of the claim, hence decreasing the occurrence of claims. You choose to pay a part of the claim by raising your deductibles out of your cash, and the company will eagerly reduce your premium.

Choose seasonal insurance during the offseason

Fire, theft, vandalism, and winter storms can all cause significant damage and financial burden. You won’t be insured for any winter tragedy that strikes your yacht during the off-season if you don’t have insurance. You’ll be responsible for possibly astronomical expenditures.

Pick a modern boat rather than an old one

A new yacht will cost less to insure than an older one. This is because older ones are susceptible to acquiring defects, while newer ones are not. Further, you can take several steps to improve your yacht’s safety, contributing to lowering your cost. Like, installing an autonomous fire control system may decrease the danger of fire damage and make you eligible for a premium reduction. Additionally, safety devices like radar, depth finders, first aid kits, GPS, emergency kits, and EPIRBs may reduce the danger.

Our advice to find the best insurance broker at the best cost for a yacht

Avoid using your home and car insurer for yachts above 27”.

Usually, boat insurance is meant for vessels less than 26 feet long. Yachts are generally longer than 27 feet, have far more powerful engines, and cost more than smaller vessels.

Yachts typically go greater distances and deeper seas, transport more passengers, need a crew and have several equipment and personal possessions. These variables result in distinct risk exposures and need particular insurance policies, coverage choices, and deductibles.

Maritime law governs rather than state or federal law in deeper seas, which may be more complex. If your boat has a crew, you might be obliged to have Harbor workers and Longshoreman’s covers.

Partnering with an advisor who knows the worth of your boat and how you intend to use your boat can assist you in getting the necessary coverage for any potential catastrophes. You will also need specific insurance coverage if you own a high-performance boat due to the increased risk.

Pick a trustable company with expertise in marine insurance

You can choose your regular insurance provider to get your marine insurance. There are several maritime governing rules when you decide to sail on the sea or plan to sail overseas. Additionally, it is essential to engage with a provider that has a deep understanding of boat and yacht coverage. This is vital at the time of insurance application and in the severe case of a claim.

Special needs might require custom policies

If you have any special needs, additional coverage choices are available for medical costs, private possessions, the boat’s transportation equipment, and more that may be added to any plan. However, that relies on the type of insurance provider you choose.

Optional coverage extensions:

- Trip disruption

- Private property

- Trailer Coverage

- Towing and Emergency Roadside Service

- Uninsured Watercraft

- Individual Liability

Get an experienced yacht broker to help you navigate policies.

You may have 100 policies in front of you and many lucrative offers claiming several things. Yet, making the right insurance takes time and a better understanding of all the coverage. So, an experienced broker can help you navigate all these policies and select one that fits your budget and particular situation.

The best companies for yacht insurance

Many insurance firms provide boat insurance at affordable prices. Shop around to ensure that you receive the necessary information to make an educated selection. Also, there are several websites that offer evaluations of various insurance providers and are excellent starting points for your study.

Communicate with other sailors; determine which aspects they value and why. You would be in a position to make the most excellent option for your requirements when you analyze the services of various companies.

Being on the ocean is a feeling of serenity, tranquility, and impending new experiences. So, this is an encounter you want to go on forever. Further, your sailing boat is a significant investment. Hence, consider having your luxury boat insured to cherish the best of life and keep your investment safe.

Don’t take chances with your yacht, act now and ensure a safe and worry-free sailing experience

Now that you understand the importance of yacht insurance, don’t wait any longer to protect your valuable asset. Contact us today to get a quote and secure peace of mind on the water. Our team of experts will guide you through the process and help you choose the best coverage for your needs.

Frequently Asked Questions

All ship and yacht owners are obliged to have marine insurance, mainly when the vessels will be utilized for commercial or transit reasons and move people, labor, or goods overseas.

our yacht insurance usually protects your yacht against frequent dangers such as drowning, storm, fire, collisions, and theft. You may also be protected by boat insurance if you accidentally harm somebody or destroy their property. Your coverage may cover the following boat components: machinery, attached equipment, hull.

The exclusions from yacht insurance policies include: criminal actions of others, insect infestations, lack of due diligence on the part of the assured or managers, common wear and tear, loss resulting from delay, and intentional wrongdoing by the captain or crew.

The typical cost of boat coverage is between $200 and $500 per year. However, insurance may cost between 1 and 5 percent of the boat’s worth for a yacht or sailboat. For instance, you may spend around $2,500 annually to insure a boat worth $100,000.

Sailboat owners often spend between $250 and $1,500 annually to protect their yachts. This price varies depending on various criteria, including insurance type and insurance amounts, and sailboats usually are less costly to cover than powerboats.

Annual insurance on the yacht will range at roughly 1.5 percent of the boat’s value. The cost to insure a catamaran depends on hull valuation, location, and the boat’s operation.

The insurance coverage of a mega yacht or a super yacht can be around $240,000.

To reduce the cost of yacht insurance, you can take the following steps: installing safety equipment, demonstrating better boat riding skills by undertaking a boating course, considering your deductibles, limiting your sailing area or working on credit scores.

Hull relates to the vessel’s body. The insurance will cover unexpected damage or loss to the boat anywhere inside the policy’s specified maritime boundaries.

Usually, classic boat insurance is provided by specialized insurance firms who specialize or have experience in protecting classic and antique vessels. For covering your old boat, get a quotation from a specialized insurer and verify that your policy provides the protection you want for a sense of security.

Luxury Yacht Charters in Croatia : Our Guide

Mediterranean islands: our ultimate guide, you might also like.

What differentiates a yacht from a superyacht or a mega yacht?

Chartering Requirements and Regulations: A Guide for Boat Owners

What are the Fastest Cruising Catamaran on the Market?

Yacht Insurance

Table of Contents

How Does Yacht Insurance Work?

What doesn’t yacht insurance cover, who needs yacht insurance.

Yacht insurance is designed to offer liability and physical damage coverage for boats of 27 feet or more in length. This coverage can apply to incidents resulting in bodily injury or damage to the property of others while the yacht is being operated, and it can also cover certain perils – like fire, theft, vandalism, or wind – that cause damage to the hull, engine, or other attached equipment.

You may also be able to obtain coverage for personal items on board the yacht and for towing after an accident occurs.

Much like car insurance , yacht insurance provides a means to submit claims for damage inflicted upon your boat and any injury or losses inflicted upon third parties. If your policy includes coverage for such incidents, your insurer will offer coverage up to the limitations and provisions stipulated in your policy.

There are two common types of yacht insurance policies, which each dictate how a total loss to the yacht will be settled after a covered peril occurs, subject to the applicable deductible :

- An agreed value policy costs more upfront, but if the yacht is declared a total loss, the insurance company will pay you the value as listed in the policy. This amount is agreed upon between you and the insurer when coverage is selected, and an appraisal or sales receipt may be required as verification.

- An actual cash value policy considers depreciation and market value, so you'll only receive the worth of the yacht in a total loss settlement. This policy is typically cheaper, but it provides less coverage.

A typical yacht insurance policy's two primary sections are hull insurance and liability insurance .

The hull insurance section of your policy will cover any accidental, physical damage to or loss of your yacht, including its hull, the engine(s), sails, and other attached equipment needed for its operation. Personal property stored on the yacht may also be covered, depending on the specific policy. This coverage will protect both you and the lender if your yacht is financed.

The liability section covers any legal liability you may have to a third party due to the ownership or operation of the yacht, such as for bodily injury, loss of life, or damage to their property.

There may also be coverage for instances other than collision where you cause damage to another yacht. For example, if you fail to yield to a yacht that has the right of way and it subsequently runs into a channel marker to avoid hitting you, you could still be held liable for the damage.

Looking to insure a boat under 27 feet in length or a personal watercraft? Learn about boat owners insurance .

Typically, a yacht insurance policy will not cover regular wear and tear, mold damage, animal or insect damage, or malfunctioning or broken machinery. Coverage for personal property and unattached equipment like fishing gear may also be limited or excluded completely.

When considering yacht insurance, you should speak to your agent and understand what is and isn't covered by the policy.

Obtaining yacht insurance is typically optional, but it may be advisable to protect your boat and other belongings, yourself, and the people sailing with and around you.

Additionally, many marinas require yacht insurance to use a slip or mooring, and you’ll need a policy if you’re financing your yacht purchase to protect your lender’s financial interest .

Why You Can Trust Us

U.S. News 360 Reviews takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Related Articles

Best Car Insurance Companies

Best Homeowners Insurance Companies

Best Life Insurance Companies

Best Renters Insurance Companies

Best Pet Insurance Companies

Best Small Business Insurance Companies

Related Terms

Water Damage Insurance

Travel Insurance

Air Cargo Insurance

Fire Insurance

Liability Insurance

Insurance Claim

Insurance Premium

Boat Insurance Guide

Boat Insurance Guide: Costs & Coverage

When it comes to insuring your boat, it’s often best to separate your boat insurance from your homeowner's policy. Many homeowners’ policies limit or don’t cover marine-specific risks, such as salvage work, wreck removal, pollution or environmental damage; but there are exceptions.

Types of Boat Insurance

- Boat Insurance Costs

- Boat Insurance FAQs

Insurance Factors

Insurers consider many factors when deciding whether or not to offer a policy. Almost any vessel can be insured— for a price. You want to consider the following to make sure the policy you purchase meets your needs:

- Age of Boat

- Speed/Horsepower

- Condition (Does it meet US Coast Guard Standards in effect at the time it was built?)

- Primary residence (If the boat is used as a primary residence)

- Type (Inboard, Outboard, utility, cruiser, bassboat, saltwater fishing boat, performance boat)

- Homemade (Boats without a serial number are tricky but many kits are okay)

- Houseboats with no motor

- Ownership (more than 2 owners)

- Where it will operate (Ocean, lakes, bays, rivers, Great Lakes)

There are two basic types of boat insurance— “agreed value” and “actual cash value.” How depreciation is handled is what sets them apart.

An "agreed value" policy covers the boat based on its value when the policy was written. While it can cost more up front, there is no depreciation for a total loss of the boat (some partial losses may be depreciated).

"Actual cash value" policies cost less up front, but factor in depreciation. In other word, the policy will only pay up to the actual cash value of the boat at the time it is declared a total or partial loss. Eventually, as your boat ages, your insurer will likely insist on an actual cash value policy—and if often gives a substantial savings.

Kinds of Boat Insurance Policies

- Personal Watercraft ( PWC )

- Yacht - generally, vessels 26' and smaller are called "boats,” and "yachts" are 27' and larger. Yacht coverage tends to be broader and more specialized because larger boats travel farther and have more unique exposures.

- Boat & PWC Rental - Although this is generally not required, rental insurance will help cover any damage the vessel, as well as the operator and passengers.

- Boat Clubs - covers all members of club while operating a boat.

- Professional (ProAngler, Fishing Guides & Charters) - These policies are very customizable and can cover items like travel to a tournament, equipment and more.

What Boat Insurance Policies Cover

How and where you boat determines the type of coverage you need. An "all risk" policy will offer the best protection. However, an “all risk” policy does not cover every type of loss. In insurance terms “all risk” just means that any risk not specifically omitted in the policy is covered. Typical exclusions include wear and tear, marring, denting, animal damage, manufacturers’ defects, design defects, ice and freezing.

You may also be able to add extra coverage. Available options may include: medical payments, personal effects, uninsured boaters liability, and towing and assistance. Most policies will cover permanently attached equipment, as well as items like anchors, oars, trolling motors, tools, seat cushions, and life jackets. Be sure to discuss these options with your agent.

Types of Boat Insurance Coverage

This will depend on the type of policy, but common coverage add-ons (in addition to basic ones above) include:

- Specialized Coverage: Coverage for something specific on your boat like an expensive prop or navigation equipment.

- Salvage: Coverage that pays to remove your boat due to damage, from substantial to minor.

- Consequential Damage: Covers a loss that was the result wear and tear rather than an accident (rot, mold, corrosion).

- Towing: Towing your boat across a body of water to safety can cost $400 per hour.

- Cruising Extension: You can get temporary, additional coverage if you plan on leaving the USA (typically to Mexico or the Bahamas).

Insurance Claims

Hopefully, you will never need to make a claim but if you do, it’s good to be prepared. You are not required to carry proof of insurance on your boat, but it’s a good idea keep claim information handy for an emergency. Ask how the claim process works when you’re shopping for policies. Naturally, it should be quick and easy. In addition, find out if your agent (or other representative) will be available if you need help dealing with the aftermath of a claim, such as arranging for towing or salvage, rather than just cutting a check and leaving.

Shopping for Boat Insurance

Start with a little fact-finding. Ask your boating friends which company they use and how their claims have been handled. The way an insurer has handled claims in the past is a good indicator of the quality of service you can expect in the future.

State insurance regulatory agencies are also a good reference and can be found online.

Boat Insurance Cost Factors

- Cruising Area: Where you boat.

- Boating Safety Education: If you have been formally trained or certified.

- Good Driving Records: Both boating and driving.

- Liability Limits: The higher the limit the higher the cost.

- Deductible: The higher the deductible the lower the premium.

- Towing insurance requirements for offshore fishing (for example, a 20-mile tow could cost $3,000).

If you boat in a hurricane zone, your insurer may expect you to provide a hurricane plan. If a storm approaches, will you have it stored in a hurricane-proof facility or will you tow it or skipper it to a safer harbor. The answer can affect your rates, even lower them, but be prepared to follow the plan, because your coverage may hinge on it.

Insurance Discounts

There are a few ways to reduce your boat insurance costs. For example, if your boating is restricted by seasons and your boat is in storage during the winter, you can get deductions for winter layup. Many insurers offer discounts for good driving records and for anyone who has completed boater education classes. Finally, it usually costs less to be insured in fresh water versus salt, so be sure to discuss where you boat with your agent. You may earn extra savings by bundling your coverage with the same company that insures your home and/or car.

Before you buy your new vessel, it’s a good idea to determine your insurance costs based on your needs.

Boat Insurance Coverage FAQs

Small Boat (29' or less) Insurance

What is the best coverage for my boat?

It is best to have what is known as an "All Risk" policy, which will provide coverage for all types of losses except those specifically excluded in the policy. Typical exclusions may include wear and tear, gradual deterioration, marring, denting, scratching, animal damage, manufacturer's defects, defects in design, and ice and freezing.

How much should I insure my boat for?

You should insure your boat for the amount it would cost you to replace it with like kind and quality. This is called "Agreed Value" or "Stated Value" coverage, and in the event of a total loss, will pay the full insured amount. Beware of policies providing "Actual Cash Value" (ACV) coverage, which means the value of your boat will be replacement cost less depreciation.

What other coverages can I expect with my policy?

The following are standard coverages with standard deductibles and average limits:

- Medical payments, $5,000

- $1,000 limit Personal effects, $250 deductible

- Uninsured boaters liability, between $300,000 and $500,000

- $500 to $1000 limit Towing and assistance, no deductible

- $1,000 limit Fishing equipment, $250 deductible

Who is allowed to operate my boat?

Most policies will allow anyone to operate your boat so long as you have given them permission. There are exceptions, of course, especially with high performance boats or personal watercraft so always read your policy. But beware, too many additional drivers often results in increased premiums.

I live in an area where I can't use my boat in the winter, but my lender requires it be insured year-round. What can I do?

Ask your insurance agent if they offer what is commonly referred to as a “lay-up” discount. You have year-round coverage with a discount for the months your boat is in dry storage.

Large Boat (Greater than 29') Insurance

What are the differences between boat and yacht insurance?

Generally "boats" are considered to be 26' and smaller, and "yachts" are 27' and larger. Generally speaking yacht coverage is broader and more specialized because larger boats travel further and have more unique exposures.

What should I look for in a yacht policy?

There are two main section s of a yacht policy. Hull insurance is all risk direct damage coverage that creates a very broad insuring agreement. It will include agreed amount hull coverage, meaning all parties agree at the time the policy is written on the value of the vessel and that value will be paid in the event of a total loss.

A true yacht policy also includes replacement cost (new for old) coverage on partial losses, with the exception of sails, canvas, batteries, outboards and sometimes outdrives, which are depreciated. Protection and indemnity insurance is the broadest of all liability coverages, and because maritime law is unique, you will need coverages that are designed for those exposures. Such things as Harborworkers and Longshoreman's coverage and Jones Act (crew) coverage can be critical, as an uncovered loss in this area could run into hundreds of thousands of dollars. Besides providing payment of judgments against you, P&I also provides for your defense in Admiralty Courts.

What is a normal deductible?

A yacht policy usually carries a percentage of the insured value deductible, for instance a 1%, deductible means a boat insured for $100,000 would have a $1,000 deductible. Most lenders allow a maximum deductible of 2% of the insured value. Beware of "named special deductibles" such as storm damage of 10% or more.

What are some of the other standard coverages I can expect?

These standard coverages have standard deductibles and average limits:

- Medical payments, $10,000 limit

- $5,000 limit personal effects, $250 deductible

- $500,000 limit uninsured boaters liability, no deductible

- $1,000 to $3,000 limit Towing and assistance, no deductible

- $1,000 Hurricane haul out coverage. Small percentage of limit as deductible. Hurricane warning must be posted by NOA. Payment made to move boat to safe location, haul out or make special preparations to withstand storm.

What is Breach of Warranty?

That is coverage that primarily protects the lienholder's interest in your boat, paying off the balance owed but nothing more. If you breach the warranties in the policy, such as promising not to go outside your navigational limits, not to use your boat during the lay-up period, not to use your boat for anything but private pleasure use, and you do NOT have this coverage and experience a loss, you don't get paid for that loss and neither does the lender. You could end up making payments on a boat you cannot use.

Editor's Note: Information Courtesy of National Marine Lenders Association .

Latest Wave of Boating News & Resources

Inspirational stories, how-to articles, and expert tips for new & experienced boaters

What is a Sterndrive, and is It Right for You?

Sterndrives, also known as inboard/outboard engines, are popular among boaters for their unique blend of power and versatility.

8 Waterfront Music Festivals You Can Get to By Boat

What is the only thing better than attending a multi-day music festival? Getting to experience it on the water! Instead of battling concert traffic, boaters have the unique luxury of attending various music and art festivals by boat.

8 Tips for Planning a Wedding on a Boat

Want to host your wedding on a boat? Not only are boats cost-effective venues, but they're a romantic, unique, and memorable way to tie the knot (pun intended).

Join Our Newsletter!

Get community news, buying bargains, and how-to guides at your fingertips.

Boat Reviews

- Boats Specs

- Marine Pros

- Boat Insurance

- Boat Warranties

- Boat Transport

- Boat Towing

- Marine Forecasts

Your Ultimate Boating Resource

Anchoring Your Peace of Mind: The Complete Handbook on Boat Insurance Coverage and Selection

Envision the serenity of gliding across a glistening sea, the sun casting golden reflections on the water, your boat moving effortlessly through the waves. It’s the epitome of freedom and joy that comes with owning a boat, a dream cherished by many.

Yet, beneath this serene tableau lies an ocean of unpredicted risks and challenges. In these waters, boat insurance emerges not just as a necessity, but as your steadfast beacon of security. It shines light on the dark, uncharted possibilities, offering you protection and peace of mind.

This comprehensive guide will navigate you through the essentials of coverage, compensation, and selecting the ideal policy, ensuring your maritime journey is as safe as it is exhilarating.

Dive Deep into Coverage

Your boat is more than just a fun way to spend a sunny day on the lake–it’s an investment. But accidents and unexpected damage can mean financial disaster without the security of boat insurance.

You’ll be covered for any physical damage, like collisions or theft, but you’ll also be safeguarded from liability if another person gets injured while on your boat or their property is damaged.

Arm Yourself with Knowledge

There are several types of coverage available, which include things like mechanical breakdowns, salvage costs, and navigational limits for larger boats.

But most importantly, properly understanding the insurance coverage options provided in your policy could save you thousands of dollars in the long run.

Evaluate Insurance Options

When thinking about boat insurance, you have to consider the advantages and disadvantages of Actual Cash Value (ACV) and Agreed Value (AV) policies.

An ACV plan is likely more affordable initially, however the payment in case of a total loss decreases as your boat ages. It means that if your boat is damaged, the insurance company will give you what your boat is worth at that point, minus your deductible.

For an AV plan, you make a deal with the insurer on the value of your boat when you start the policy. If you suffer a complete loss, they pay out that prearranged amount. This can provide more security for new or costly boats, but may not be beneficial for older ones.

Eventually, the choice depends on aspects such as the age and condition of your watercraft, your budget, and how much risk you’re willing to take.

Grasp Restrictions

Comprehending navigational restrictions in your boat insurance policy is critical, as these dictate the geographical area in which your boat is protected. These rules are particularly necessary for larger boats, such as yachts, where cruising areas can be more extensive.

If you journey outside the outlined area in your policy, you could forfeit your insurance coverage. Meaning, any damage or obligation incurred beyond those bounds won’t be covered by your insurer. These are like boundary lines set by your insurance. They define where you can take your boat and still be covered.

The navigational limits are often established according to the type of boat and intended usage zones–for instance seas, lakes, rivers, or coastal regions. Policies with broader navigational boundaries usually require higher premiums, highlighting the augmented danger associated with a wider marine region.

It’s paramount to accurately gauge your seafaring practices and regions of operation when deciding on an insurance plan to guarantee that you are sufficiently shielded within your ordinary boating area.

If you decide to take on a longer journey or switch sailing areas, it’s best to speak with your insurer to modify your policy accordingly.

Gain Complete Protection

Essential coverage may include liability, salvage, medical coverage, and protection against uninsured boaters. Plus, personalize your policy with specialized add-ons for extra security.

Additional services like towing services, fuel delivery, hauling protection, and mechanical breakdowns/special equipment coverage can guarantee that you are equipped for any unforeseen circumstances while captaining the open seas.

Select the Right Policy

The dimensions, class, and location of your boat determine whether an insurance company will create a policy for it. You can decide between larger companies that offer multiple types of coverage, or select specialized ones that understand boating better. Both options have advantages, so choose what best fits your requirements and expectations when making this crucial decision

When determining which insurance provider to safeguard your beloved boat with, it is paramount to consider if an individual policy should be taken out instead of a homeowner’s policy.

Homeowner’s policies may restrict or exclude marine-specific risks, but they can cover smaller boats adequately. It is almost always wise to go with a dedicated marine insurer for total and complete coverage.

Dedicated marine insurers are equipped with the knowledge to provide comprehensive coverage tailored for maritime boats.

Be Vocal about Needs

Securing the right boat insurance policy requires extensive research and a deep understanding of your particular needs. Consult experienced boaters for advice and evaluate how insurers processed past claims, as that’s usually an accurate indicator of their future service quality. Inquire with local insurance agencies to gain further insight about companies’ reliability and trustworthiness.

Furthermore, understand your chosen policy’s claims process; a simplified yet supportive system is essential during times of trouble.

Make sure to choose an insurer who volunteers assistance beyond just the claim – arranging emergency services demonstrates their devotion to customer satisfaction.

Lastly, make sure to balance coverage, cost, and the insurer’s credibility for service and support when making your final decision.

Save Money, Win Benefits

Saving money on boat insurance doesn’t mean you have to compromise on coverage. There are various ways to reduce costs while maintaining adequate protection.

These include opting for policies with diminishing deductibles, which reduce your out-of-pocket costs over time.

Completing boater’s safety courses can also lead to discounts, as many insurers offer incentives for educated and safe boaters.

Bundling your boat insurance with other policies under the same insurer can also lead to savings.

Additionally, some insurers collaborate with boat manufacturers to offer special deals, which can be a cost-effective option if you own a boat from one of these manufacturers.

Final Thoughts

Now that you are armed with a guide offering actionable advice, such as the importance of understanding policy restrictions and how to choose between different types of insurers, you can leave the harbor with confidence, knowing that you are well-informed and totally secure.

So, unfurl those sails, and keep a peace of mind!

RELATED ARTICLES

Overview of the 2024 sea-doo rxp-x 325, overview of the 2024 parker offshore 2900 cc, what your boat’s beam is and why it matters, power cats of 2024: ultimate guide to the top power catamarans this year, navigating the heat: 10 safety tips for a safe boat ride in the summer heat, latest posts, don't miss, our newsletter.

Get the latest boating tips, fishing resources and featured products in your email from BoatingWorld.com!

What type of wood is used for pier pilings?

What is the difference between a dock and a floating pier, what is the proper technique for pulling a beginner wakeboarder, what does ‘no wake’ mean on a lake, what is the difference between wash and wake, highs, lows, and tidal know-how: a deep dive into ocean currents, 10 essential tips for fishing near private property, the benefits of using a drift sock: guidance for anglers, lure fishing: secrets for imitating live bait and attracting fish, explore the untapped depths of america’s best bass fishing spots, outboard motor maintenance: tips for keeping your engine in top shape, the essential boat tool kit: tools every boater needs, diy boat building: 8 tips and tricks for building your own vessel, the art of miniature maritime craftsmanship: ship in a bottle, antifouling paints: a guide to keeping your boat shipshape, beginner’s guide to standup paddle boarding: tips and techniques, boating for fitness: how to stay active on the water, kayak safety: how to stay safe on the water, anchoring in a kayak or canoe: how to secure your small boat, overview of the 2024 yamaha 252sd, overview of the 2024 tiara yachts 48 le, overview of the 2024 bass cat jaguar sts, 2024 pursuit os 445: an overview, 2024 aquila 47 molokai review, 2024 sea-doo switch 13 sport review, gear reviews, megabass oneten max lbo jerkbait review, fortress anchors fx-7 anchoring system review, fortress anchors fx-11 anchoring system review, fortress anchors commando anchor kit review, fortress anchors aluminum anchors review, stay in touch.

To be updated with all the latest news, offers and special announcements.

- Privacy Policy

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

Yacht Insurance

Finding the perfect coverage has never been easier.

Insurance doesn’t have to be boring. That’s why we hired Sara East to be our BA insurance writer. Maggie specializes in making mundane subjects hella-entertaining.

Yachts are a luxurious way to be on the water, but owning a yacht means having the right insurance in the event of damage or being destroyed. Because of their price, repair or replacement is likely to be very expensive making the proper coverage crucial for boat owners.

Before using your yacht, an independent agent can work with you to create a customized yacht insurance policy to your specific watercraft, its value, and how you use it.

Boating Statistics

No one likes to think about the dangers of boating, but accidents can happen and it's best to be prepared in the event that you face unexpected hardship. Whether you hit another boater, have an incident with a passenger, or your boat is damaged while being transported or docked, lots of things can lead to a financial headache for you.

Here are some statistics about boating accidents.

- Cabin motorboats, which include yachts, accounted for 14% of all boating accidents

- Only about 20% of all boaters who drowned were on vessels larger than 21 feet

- Operator inattention was cited as the leading cause of accidents involving cabin motorboats

What Is Yacht Insurance and What Does It Cover?

Yacht insurance is a specialized type of boat insurance for luxury boats. Yachts can be used for personal as well as commercial use, so insurance policies must be created to accommodate each of those needs.

While yachts, like most boats, depreciate over time, they still generally have a much higher than average value. Because of their high values, a standard boat insurance policy may not provide enough coverage for your vessel.

The components of yacht insurance are similar to standard boat insurance coverage.

- Bodily injury and property damage liability: Covers the costs associated with injuries or property damage you cause to another person, as well as legal fees. If the liability limits in your yacht insurance policy are not adequate to protect your assets from a lawsuit, you may want to consider buying an umbrella liability policy , which provides a much higher liability limit.

- Collision coverage: Pays for damage to your boat after a collision with another boat or object.

- Comprehensive coverage: Covers non-collision damage or loss, including theft, fire, vandalism, or damage caused by an object other than another boat.

Additional yacht insurance options to consider

- Uninsured/underinsured boaters insurance: Covers any damage or injuries from an accident with an uninsured or underinsured boater. Since boat insurance is rarely required by law, if you have a significant amount invested in a vessel, this is a good insurance option to discuss with your agent.

- Medical payments coverage: Covers medical expenses and funeral expenses for anyone on that is injured, entering, leaving or while on your boat.

- Equipment and personal effects coverage: Pay to repair or replace damaged or lost items such as gear, fishing equipment, cameras, and other personal belongings.

An independent agent can work with you to determine the appropriate coverage for your needs. Because these agents work with multiple insurance companies, they can help protect all of your interests with a broad range of insurance coverage, all from one agency office.

Is Yacht Insurance Different from Standard Boat Insurance?

Yacht insurance provides similar types of coverage as standard boat insurance . However, yachts have some specific differences from standard boats, and yacht owners generally need certain protection that regular boat insurance does not provide.

For example, a yacht policy tends to restrict hauling on a trailer to only a few hundred miles, while boat insurance tends to provide coverage for trailering over longer distances.

Also, deductibles for yacht policies are very flexible, instead of having set amounts like $250, $500 or $1,000. In addition, yacht policies can include coverage for raising and removing a sunken yacht, while boat policies generally do not include this coverage.

Is Yacht Insurance Required?

Yacht insurance is not typically required by state law. However, sailboats often do have insurance requirements. So, if you have a sailing yacht, insurance may be required by law.

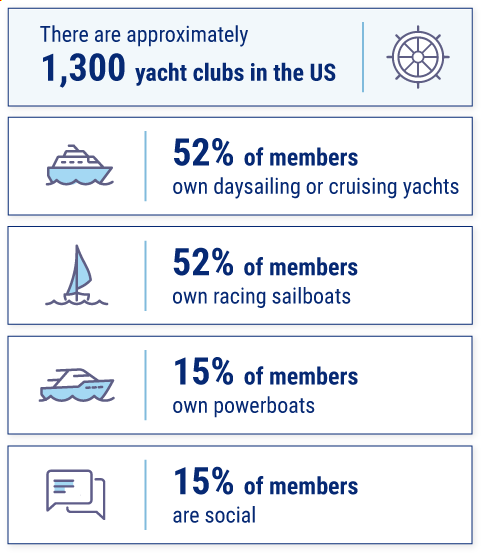

Yacht club membership statistics

You will also need to buy insurance to protect your investment in your vessel if you finance the purchase of your yacht through a lender.

Many marinas require that you have insurance in order to slip your boat at the marina. Check your local marina's guidelines, and be sure to learn about your state’s laws and regulations.

Do I Need Yacht Insurance?

A yacht can range in price from $300,000 to several million dollars. Purchasing one is a big investment and having the ability to insure your investment can ease your mind if there's an accident or your yacht needs repairs or replacement.

Insuring your yacht is also not just about the boat. In the event that an injured party files a liability claim against you, you will want to have enough coverage in place to protect your boat, home, savings, investments, and future income.

Assessing your financial situation will help you to determine how much yacht insurance you need.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

How an Independent Insurance Agent Can Help with Yacht Insurance

A local independent agent will talk with you, free of charge, to learn about your yacht and insurance needs. They'll gather multiple quotes for you from several different companies and help you compare options and rates. Your agent can assist you with every aspect of your insurance and will be your point of contact if you need to file a claim.

An independent agent can help to prevent gaps in coverage that leave you exposed to risk. You will know you are getting the right coverage for your needs, and that you are not paying for any unnecessary coverage.

https://www.ussailing.org/wp-content/uploads/2018/01/Demographics2010.pdf

- Search Search Please fill out this field.

- Personal Finance

Watercraft Insurance: What It is, How It Works

Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed.

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

- Property Insurance: Definition and How Coverage Works

- The Importance of Property Insurance

- Personal Liability Insurance

- Scheduled Personal Property

- Non-Scheduled Personal Property

- Floater Insurance

- Unscheduled Property Floater

- Wear-and-Tear Exclusion

- Jewelry Floater

- Designer Clothes

- Consignments

- Guide to Landlord Insurance

- Best Landlord Insurance

- Do You Need Mobile Home Insurance?

- Modular vs. Manufactured Home Insurance

- How to Insure Your Tiny Home

- Watercraft CURRENT ARTICLE

- Umbrella Insurance

- How Umbrella Policies Work

What Is Watercraft Insurance?

Watercraft insurance is an umbrella term for three types of insurance: boat insurance , yacht insurance , and personal watercraft insurance. It protects against damages to vessels powered by a motor that has a horsepower of at least 25 miles per hour (mph). Examples of the types of costs covered by watercraft insurance policies include physical loss or damage to the boat, theft of the boat, and towing.

Key Takeaways

- Watercraft insurance is an umbrella term for three types of insurance: boat insurance, yacht insurance, and personal watercraft insurance.

- The type of coverage you buy is dictated by the size of your vessel.

- Although watercraft insurance is not required in many states, many boat owners choose to purchase it anyway.

- Boat-loan providers and marinas often require boat owners to have watercraft insurance.

How Watercraft Insurance Works

Depending on the policy, there may also be watercraft liability coverage for bodily injury to people other than the boat’s owner and family, guest passengers using the boat by themselves, and medical payments for injury to the owner and their family. Some policies, however, require the purchase of additional liability coverage as an add-on. The specific type of insurance you buy is dictated by the size of your vessel.

Watercraft insurance is similar to other types of insurance products. In exchange for paying a series of insurance premiums, the policyholder receives protection from certain rare but potentially costly risks. Depending on factors such as the size of the craft, its age, and its intended uses, the premium costs may range from relatively inexpensive to pricey. When underwriting a policy, an insurance company will also consider the policyholder’s track record of previous claims.

Boat Insurance

Any vessel under 197 feet long is considered a boat, while ships are 197 feet or longer. The dividing line between boat and yacht is less settled. Some sources define a yacht as at least 30 feet long. Anything shorter is a pleasure boat. For insurance purposes, the National Boat Owners Association marks the dividing line at 27 feet.

Small craft, such as canoes, rowboats, small sailboats, and powerboats with less than 25 miles-per-hour horsepower may be covered under a standard homeowners or renter’s insurance policy. However, such coverage is unlikely to include liability insurance. Typical boat insurance covers theft; physical damage to the boat itself due to a collision or striking a submerged object; property damage to the boat caused by vandalism, a windstorm, or lightning; and medical payments for injured passengers and the owner and their family. For each coverage, there will be different deductibles, which is how much you must pay out of pocket before your insurance kicks in. Boat insurance will often provide better liability insurance than a homeowners policy, but it is often wise to purchase additional liability coverage as an add-on.

In the event of a total loss, it is important to know whether your policy pays actual cash value (ACV) or agreed value (AV). ACV is cheaper because it only pays for what the boat was worth at the time of the loss, factoring in depreciation and wear and tear on the vessel. AV pays a price that you and your insurer agree upon in advance, an amount that is likely to be closer to the amount you paid for the boat when new.

Other considerations for boat insurance can include:

- Lay-up period —This covers your boat for property damage during the off-season, when it isn’t in the water.

- Navigational territory —Your insurance will generally specify where you can go in your boat and still be covered.

- Property damage —This is for damage your boat inflicts on someone else’s property.

- Hurricane haul-out provisions —This covers your costs of getting the boat out of harm’s way before a windstorm.

- On-water towing and assistance —This is for unexpected breakdowns or running aground.

- Fuel spill liability protection —Should there be an accidental discharge of fuel from your boat, this will cover the costs of a clean-up.

- Personal effects coverage —This will protect any expensive equipment you have on your boat, such as fishing gear

- Ice and freeze coverage —Should cold weather damage your boat’s engine and water systems, this will pay the bill.

Yacht Insurance

Most yacht coverage is broader and more specialized than pleasure boat coverage because larger vessels travel farther and are exposed to greater risks. It also generally costs more, in part because yachts cost more . In terms of a deductible, it is usually determined as a percentage of the insured value. With a 1% deductible, a boat insured for $175,000 would have a $1,750 deductible. Most lenders allow a maximum deductible of 2% of the insured value.

Generally, yacht insurance coverage does not include wear and tear, gradual deterioration, marine life, marring, denting, scratching, animal damage, osmosis, blistering, electrolysis, manufacturer’s defects, defects in design, and ice and freezing.

There are two main parts of a yacht insurance policy: hull insurance and protection and indemnity (P&I). The first is an all-risk, direct damage coverage that includes an AV for hull coverage, and in the case of a total loss, it will be paid out in full. Replacement cost coverage on partial losses is also available. However, sails, canvas, batteries, outboards, and sometimes outdrives are usually subject to depreciation instead.

P&I insurance is the broadest of all liability coverages, and because maritime law is particular, you will need coverages that are designed for those exposures. Longshore and harbor workers’ coverage and Jones Act coverage (for the yacht’s crew) are included and are important because your losses in these areas could run into six figures. P&I will cover any judgments against you and also pay for your defense in admiralty courts .

Personal Watercraft Insurance

Personal watercraft insurance is for recreational vehicles such as Jet Skis , Sea-Doos, and Yamaha Wave Runners. These surface-skimming craft can have engines with horsepower anywhere from 60 mph to 310 mph. They usually are not covered by homeowners insurance, and even when they are, the coverage limits are low.

Personal watercraft insurance covers the owner and anyone they allow to use the craft for risks such as:

- Bodily injury to another person

- Bodily injury to you that is caused by an uninsured watercraft operator

- Liability in the form of legal costs if you’re sued due to an accident (which can include water sports liability for things such as waterskiing risks)

- Property damage to another watercraft, a boat, or a dock

- Towing after an accident

Deductibles and liability limits will vary depending upon the policy and the company offering it. You can buy additional coverage for trailers and accessories and, if you own more than one craft, you may be able to bundle your insurance policies for a discount. These pleasure vehicles are easy to use but can also be dangerous, causing thousands of injuries every year, which makes personal watercraft insurance a wise investment.

Watercraft insurance policies may limit the geographic areas in which the boat or watercraft can be operated while maintaining coverage. These often include inland waterways, rivers, and lakes, as well as ocean waters within a certain number of miles from shore.

Do I Need Watercraft Insurance?

Only a few states make it mandatory for boat owners to obtain watercraft insurance. However, many owners will opt to purchase it regardless, partly because doing so is required in order to obtain a boat loan . Marinas may also require owners to have watercraft insurance as a condition within their rental agreements.

Even if your craft isn’t worth much money, obtaining watercraft insurance is a good idea because of the risk of injury on the water, especially from a collision. Even if you aren’t at fault, you could spend a lot of money in legal fees defending yourself—much more than your insurance premiums. If you do decide to purchase this insurance, make a point of comparing policies from multiple companies before deciding on which is best for you. As with all insurance, the question is what price you put on having peace of mind.

Insurance Information Institute. " I.I.I.: Know Your Boat’s Insurance Coverage from Stem to Stern ." Accessed Feb. 6, 2022.

Westlawn Institute of Marine Technology. " Definitions of: Boat, Yacht, Small Craft, and Related Terms ." Accessed Feb. 6, 2022.

National Boat Owners Association (NBOA). " The Best Yacht Insurance Rates ." Accessed Feb. 6, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What is a normal deductible? " Accessed Feb. 6, 2022.

National Marine Lenders Association. " Insurance: Large Boats: What’s Not Covered? " Accessed Feb. 6, 2022.

DiscoverBoating.com. " Boat Insurance Guide ." Accessed Feb. 6, 2022.

Boat Owners Association of the United States (BoatUS). " Do I Need Boat Insurance? " Accessed Feb. 6, 2022.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1404648644-776f8b9a7a414d6aa3a13b21cb01f2a2.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Log in to Markel

- US Broker Agent

US customer login

Log in to make a payment, view policy documents, download proof of insurance, change your communication and billing preferences, and more.

Log in to access admitted lines for workers compensation, business owners, miscellaneous errors and omissions, accident medical, general liability, commercial property, farm property, and equine mortality.

Markel Online

Log in to access non-admitted lines for contract binding property & casualty, excess, and commercial pollution liability.

MAGIC Personal Lines portal

Log in to access personal lines products including marine, specialty personal property, powersports, bicycle, and event insurance.

Markel Surety

Log in to access Markel's surety products.

- News and press

Yacht insurance

The marine insurance leader for over 45 years.

Find a Markel marine agent and get a free, no-obligation quote today.

If you love your yacht, you’ll love our insurance.

We’ve been the yacht insurance leader for over 45 years because we provide coverages that fit your yacht and your lifestyle. Markel yacht insurance can offer distinct advantages in coverage features, options, knowledge and experience.

Why do you need yacht insurance?

Whether you own a yacht or a houseboat, we understand it’s not a typical boat and shouldn’t be covered by a typical boat insurance policy. That’s where we come in—each Markel yacht insurance policy can be customized to fit your yacht, your needs, your budget and your style.

Still not sure?

Here’s a few of the potential advantages to insuring your yacht with us:.

More complete coverage than any other carrier at no additional cost.

Experienced yacht underwriters and marine claims specialists who provide prompt, responsive service.

Discounts and cost-effective coverage options to save you money.

Flexible payment options.

Save money by customizing your yacht insurance

Actual cash value coverage (ACV) Reduce your coverage to ACV, which factors in depreciation of your yacht should you have to file a claim.

Lay-up option We’ll discount your yacht insurance premium during the winter months when your yacht is not in use.

Higher deductibles If you can manage minor repairs to your boat on your own, selecting a higher deductible will reduce your premium.

Windstorm exclusion Live in an area that isn’t at risk for a hurricane? You may consider removing windstorm coverage from your policy.

Liability only Coverage in case you damage another yacht and/or person (doesn’t require a survey—even for older boats).

What we offer

We offer coverage for a variety of watercrafts over 26 feet in length, including:.

- Sport fishing boat

Our coverages can include:

- Coverage for your yacht

- Coverage for you

- Optional coverages

Hull and equipment insurance protection including:

- Protect and recover can cover reasonable costs incurred when trying to protect your yacht from further damage after an accident

- Consequential damage for non-wood yachts–normal wear and tear and deterioration is not typically covered under a yacht insurance policy. However, if your yacht suffers damage from fire, explosion, sinking or collision because of one of these conditions, you may be protected

- Ice and freezing damage coverage if you contracted with a commercial marina or repair facility

- Agreed value for total loss

- Deductible waived on most total losses

- No depreciation on most partial losses

- Automatic tender coverage

Windstorm extra expense If there is a named storm, watch or warning, we will share the expense with you to help protect your yacht before the storm makes landfall.

Personal effects coverage For all the “extras” you physically bring onto your yacht. (i.e., smart phone, camera, etc.)

Emergency towing and assistance Coverage for towing expenses if your yacht happens to get stuck in or out of the water, including the delivery of gas, oil and parts.

Rental reimbursement coverage Coverage for when your yacht is being repaired from a covered loss.

Uninsured boater Unfortunately, not all boaters on the water have insurance. This coverage helps protect you and your family members if you are injured in an accident caused by an uninsured boater. Coverage is automatically included if watercraft liability is purchased.

Pollution liability Pollution coverage helps protects you if you are held legally liable due to an oil pollution leak or spill.

Medical payments Coverage for injuries suffered during an accident on your yacht.

Paid crew (Jones Act) Protection for you if you are legally responsible for injuries to a paid captain or crew member while on your yacht.

Protection and indemnity Coverage in the event that you are responsible for injuries to another person, or damage to their boat or property. Wreck removal is included with purchase of hull coverage.

- Boat trailer coverage

- Boat lift and boat house coverage

- Fishing tournament reimbursement for fishing boats

- Fishing equipment protection

- Transit and storage coverage

- Trip coverage

- Trip interruption reimbursement

- Personal liability coverage if you live aboard your yacht

Frequently asked questions about yacht insurance

General questions.

How much coverage do I need? Each boat, person, location and situation is different. There isn't a good way to give a "ballpark" figure for how much coverage you need. It’s best to evaluate your comfortable level of risk when protecting your boat, assets and passengers. Your best option is to call our boat specialists at +1.800.236.2453 to discuss the best coverage for you.

Can I insure my yacht for liability only? Yes, we offer protection and indemnity (liability only) coverage to help protect you in case you are responsible for injuries to another person or damage to another boat or property. Many carriers do not offer liability-only policies for yachts, or if they do, require a survey. However, Markel’s protection and indemnity coverage does not require a survey, so you’re able to do what you love without worries out on the water.

Will my policy cover normal wear and tear of my yacht? Most insurance policies will not cover normal wear and tear of your yacht and the deterioration or the resulting damage. However, if your yacht is damaged from fire, explosion, sinking, collision or stranding, you may be protected under our consequential damage coverage.

Can I use my yacht for chartering? We know that sometimes yacht owners charter their yacht for sightseeing tours or even sport fishing to help offset some of the costs of owning a yacht. Markel offers an optional limited charter coverage for these situations provided the captain of the watercraft has a minimum of 2 years loss-free experience of yachting. Additional restrictions may apply.

I live on my yacht. Am I covered? Markel provides live aboard coverage. Be sure to disclose that you live aboard to your agent.

My yacht is in a corporation's name. Can I still insure it with Markel? Our yacht insurance policy can cover corporately titled boats for both personal use and client entertainment. We do require all corporately titled boats designate a designee of the watercraft. Contact your agent to learn more.

Do I need to insure my yacht in the winter? It may seem that since you don't use your yacht in the winter you don't need to insure it. This is a risky way of looking at insurance and one that we have seen cost far too many people far too much money. Your yacht is at risk for damages at all times of the year, not only when it's on the water. For example, if your yacht is placed in storage for the winter and is damaged, you will not have any assistance in paying for those repairs without an active insurance policy.

Do you cover unique boats? We offer coverage for various kinds of boats that other insurers may shy away from, including: high performance boats, airboats, hovercraft, etc. Not sure if your watercraft will be covered? Give us a call at +1.800.236.2453 to speak with one of our marine insurance specialists.

What kind of fishing equipment is covered? Your rods, reels and tackle are automatically covered under your personal effects coverage up to the limit purchased. If that coverage isn't sufficient, our fishing equipment coverage provides insurance protection at replacement cost. Please contact one of our marine insurance specialists at +1.800.236.2453 to find out more.

Claims questions

How do I file a claim? We understand that no one wants to file a claim. That's why we do everything we can to make the process as painless as possible. You can report your yacht insurance claim by calling our office at +1.800.236.2453 or submit your claim online and we'll take it from there.

How long will it take for my claim to be processed? We are committed to investigating, evaluating and resolving marine insurance claims in a timely manner.

Is there anything I can do to help speed up the claim process? Yes, you can help streamline the claims and settlement process and avoid delays by providing the following information when you file your claim:

- Policy number

- Date, time and location of loss or damage

- Description of loss or damage

- Digital photos (if possible)

- Phone number to reach you

Additional resources

Related articles.

From boat safety tips to breaking down yacht insurance, find the information, advice, and resources you’ll need all in one place.

Warrior Sailing

Markel is a proud supporter of Warrior Sailing, an organization dedicated to healing and strengthening the lives of veterans through sailing. Visit warriorsailing.org to learn about Warrior Sailing and how you can donate to the program so they can continue to help the lives of wounded veterans.

Related products

Specialized coverage designed specifically for boats 26 feet or less, such as pontoons, runabouts, fishing boats and more.

Personal watercraft

Insurance for personal watercrafts (PWCs) such as a Jet Ski, Sea-Doo or WaveRunner.

High performance boat

Coverage for speedboats greater than 26 feet in length and capable of speeds 66 to 120 m.p.h.

The global authority in superyachting

- NEWSLETTERS

- Yachts Home

- The Superyacht Directory

- Yacht Reports

- Brokerage News

- The largest yachts in the world

- The Register

- Yacht Advice

- Yacht Design

- 12m to 24m yachts

- Monaco Yacht Show

- Builder Directory

- Designer Directory

- Interior Design Directory

- Naval Architect Directory

- Yachts for sale home

- Motor yachts

- Sailing yachts

- Explorer yachts

- Classic yachts

- Sale Broker Directory

- Charter Home

- Yachts for Charter

- Charter Destinations

- Charter Broker Directory

- Destinations Home

- Mediterranean

- South Pacific

- Rest of the World

- Boat Life Home

- Owners' Experiences

- Conservation and Philanthropy

- Interiors Suppliers

- Owners' Club

- Captains' Club

- BOAT Showcase

- Boat Presents

- Events Home

- World Superyacht Awards

- Superyacht Design Festival

- Design and Innovation Awards

- Young Designer of the Year Award

- Artistry and Craft Awards

- Explorer Yachts Summit

- Ocean Talks

- The Ocean Awards

- BOAT Connect

- Between the bays

- Golf Invitational

- BOATPro Home

- Superyacht Insight

- Global Order Book

- Premium Content

- Product Features

- Testimonials

- Pricing Plan

- Tenders & Equipment

Superyacht insurance: How to choose the best policy for your yacht

Related articles.

Picking insurance coverage for your superyacht can be fraught with difficulty. BOAT reveals what owners really need to know when it comes to yacht insurance and how to keep the process as pain-free as possible if the worst happens.

When it comes to superyacht insurance, shopping around for the best deal may not be the smartest tactic. “Many of the insurance policies and contracts out there are quite similar, but, as with everything, the devil’s in the detail. Sometimes what may appear to be a really good option might contain some restrictions or exclusions in cover that might catch the unwary person out,” says Mike Wimbridge, managing director of Pantaenius UK.

Indeed, insuring superyachts worth tens to hundreds of millions of pounds, plying waters subject to windstorms and even perhaps political upheaval, is complicated. There are a lot of considerations at play and in the end what you see on your policy is what you get. “Marine insurance is not specifically regulated, meaning policy forms don’t have to be approved by any regulators in any country or state like other types of consumer insurance do. So whatever you get on your policy contract is what you get today for insurance, and it could be different for everyone,” says Nancy Poppe, North American Yacht Practice Leader at Willis Marine Superyachts.

In general, there are two types of insurance a yacht needs: Hull and Protection & Indemnity (P&I). Hull covers physical damage to the vessel and its appurtenances, while P&I is marine liability insurance for third-party liability, explains Poppe. The larger the yacht and/or the more complex its cruising programme, the more likely this coverage will be split with P&I provided by a P&I Club. “They offer a single shot $500 million P&I limit, and they can very easily offer all of the certificates,” says Spencer Lloyd, president of AssuredPartners’ yacht speciality team. “For instance, there’s something now called the Nairobi Wreck Removal endorsement and some of the companies that do both Hull and P&I do not have the ability to issue these certificates for a yacht travelling in foreign waters.”

The marine insurance market currently is a bit turbulent, which means not every yacht is insurable. A few years ago a large number of underwriters – overwhelmed by hurricanes and fires – pulled out of the marine market, creating a hard market where demand exceeded supply. It’s since stabilised to some extent, helped by the fact that 2021 churned up no serious windstorms, but underwriters today can still afford to be picky.