Global Yacht Fuel, Inc

Fuel & lubeoil supplies, united states, www.globalyachtfuel.com.

At Global Yacht Fuel we have been arranging fuel supplies exclusively for yachts since 1990 and are considered one of the industry’s top and most trusted suppliers. It is our goal to achieve long-term relationships with our clients. No one will work as hard to ensure that your experience a trouble-free delivery at the best price. Contact us today for more information and to open an account!

Tel (954) 462-6050 or [email protected]

- Fort Lauderdale United States

| Marianne Vanstone | |

| Gail Vanstone | |

News summary

Sign up to the superyachtnews bulletin.

Receive unrivalled market intelligence, weekly headlines and the most relevant and insightful journalism directly to your inbox.

The SuperyachtNews App

Follow us on

Media Pack Request

Please select exactly what you would like to receive from us by ticking the boxes below:

Membership Login

To view our digital library and complete intelligence data, please login below Alternatively please join here

SuperyachtNews.com

- Charter & Brokerage

- Yacht Design & New Builds

- Tenders & Toys

- Superyacht Events Calendar

- Career & Training

- Departments

- Superyacht Crew Finances

- Sustainability

- Shipyards and Marinas

- Health & Wellbeing

- Polar Region

- Our Services

- Meet the Team

Yachts And Fuel – How Much Do They Really Consume?

.png)

Fuel is one of many annual running costs of a yacht. Not only does the yacht need fuel for cruising; the generators require it to keep the vessel running while at anchor and underway. As well as this, many of the water sports toys require it too.

Some yachts cross the Atlantic Ocean twice a year between the Mediterranean and Caribbean while others embark on world cruises. That equates to a lot of fuel.

So How Much Do They Really Consume?

According to the Yachting Pages, the longest Superyacht in the world, 180m M/Y Azzam, holds 1,000,000 litres of fuel. To put it into perspective, that is the equivalent of filling a regular hatchback car 23,800 times. Or, six Boeing 747 commercial airliners.

West Nautical’s Vessel Manager, Tony Hildrew, a former Yacht Chief Engineer said:

“Fuel is the single biggest expense when it comes to yacht operations, it is estimated that the global spend on fuel is around $150bn annually however this shouldn’t put you off, there are a number of ways to ensure your fuel consumption doesn’t get out of hand. Implementing a Ships Energy Efficiency Management Plan or SEEMP for short is a great way to keep fuel costs down without compromising on your cruising experience.”

Each yacht will consume fuel differently for a number of reasons. It could be the size and make of the engines. Or, how often the yacht is using generators. As well as the number of tenders and water sports toys on board that require fuel. For example, if the yacht is out at anchor and running on generators 90% of the time, the fuel consumption will be much higher than a yacht that is in a marina at night and connected to shore power and water.

Another factor that will affect fuel consumption is the yacht’s itinerary. This is because the sea conditions will impact how much fuel the engines consume.

How Is Consumption Measured?

You will be able to input the start and ending points of your cruise on the map. This will automatically update the distance table. The next step is to enter the speed, fuel consumption and cost of fuel per litre to determine the cost of the trip.

Here is an example: A fast 30m yacht cruising at 20 knots will consume roughly 400 – 500 litres depending on the engine type. This would equate to the total consumption of 2500 litres for a distance of 100 nautical miles.

Another example is, a 70m yacht looking to travel 100 nautical miles with the engines burning 1000 litres per hour would add up to a total consumption of 8335L for that passage. Depending on where the yacht bunkered, the estimated cost with the price per litre being on the low end at €0.90 per litre would cost a total of €7501.50. An example of a 100 nautical mile passage would take you from Saint Tropez to The North Coast of Corsica.

How Much Does It Cost?

Fuel prices fluctuate depending on which country you bunker in and some places you bunker offer tax free fuel such a Gibraltar and Montenegro. Fuel prices can vary but typically costs between €0.80 and €1.30 per litre.

Yacht charter, sales and management company West Nautical added:

“Fuel costs should be at the top of any yacht owner and captain’s minds for two reasons: to minimise costs as well as reduce the environmental impact of burning unnecessary fuel. The superyacht charter market, more than most other markets, relies on pristine waters for their guests to enjoy their holiday. If the oceans in popular charter destinations are not maintained, it will decrease the demand for yacht charter and therefore the revenue for owners.” “If you are looking for expertise in operational management and engineering in order to plan a SEEMP, West Nautical would be delighted to assist.”

About West Nautical

West Nautical sell, charter and manage superyachts from their head office in Newcastle upon Tyne. The business currently employs a team of 21 staff throughout their offices based in the UK, Russia, France and Cyprus.

Since their inception over 25 years ago, West Nautical have become recognised as one of the most respected, trusted, knowledgeable and accountable professional services firms in yachting – largely due to their relentless determination to act in our clients’ best interests. Their approach and attitude is transparent, refreshing and focused on providing value-added services delivered simply, elegantly and affordably.

Visit West Nautical’s website here: https://westnautical.com

For Media enquiries please contact sarah.mackenzie@westnautical.com

To keep up to date with the latest Superyacht Content News, click here .

Sign up to our Newsletter below:

Newsletter Signup

- Your Name First Last

- Your Email *

West Nautical

Related articles, scorpion tenders from twisted marine. setting world class standards, navigating busy season: crew wellness tips with superyacht fitness & emma from seas the mind, tender of the week: maori 54 xl, the below deck effect. reality tv & the world’s top 1%.

Superyacht Content

Social media influencer and digital brand expert.

Superyacht Content brings you the latest in social news for the superyacht industry.

Keep up to date with us across our social channels, and don’t forget to hit that share button!

- Superyacht News

- Superyacht Jobs

- Superyacht Marketing

Join our Newsletter

Copyright © 2023 Superyacht Content | Website Design by Zonkey

Privacy | Credits | Get in Touch

IMO 2020 and the outlook for marine fuels

Imo 2020 and lower sulfur-content requirements.

In 2016, the International Marine Organization (IMO) agreed to limit the sulfur content in all marine fuels to 0.5 percent beginning in 2020, with the exception of fuel burned in Sulfur Emission Control Area regions, which are already at lower sulfur limits. The volume of oil demand affected by this change is significant. Demand for high-sulfur residual fuel oil for ship bunkers was 3.5 million barrels per day in 2018—out of 7 million barrels per day of total resid demand—and the global refining system is not yet equipped to make this volume of residual fuel oil at 0.5 percent sulfur once the regulation goes into effect.

Stay current on your favorite topics

Traditionally, the bunker-fuel market has been a sink for refiners to put high-sulfur resid material into and thereby avoid the need for expensive upgrading and hydrotreating processes. While there are currently about two million barrels per day of vacuum resid below 0.5 percent sulfur generated from atmospheric distillation, even this limited volume is not readily available for fuel-oil blending. Because many refiners lack hydrotreating capacity, those with conversion capacity are forced to use low-sulfur resid as a feedstock. Finally, most of this low-sulfur material is currently used as fuel in sectors that cannot switch to products with higher sulfur content.

The next-best source of low-sulfur fuel for shippers is marine gasoil, and we expect that this will initially be the path that most shippers take to satisfy IMO requirements. Ship engines can be switched to use marine gasoil with minimal operational change and no significant capital expense or time out of service. As marine gasoil is diesel-range material, the sulfur content can be controlled through the same hydroprocessing steps used to make low-sulfur diesel, and as global diesel sulfur limits have been lowered over the years, refiners have significantly expanded this capacity. However, diesel-range material is far more valuable than resid because of its ability to blend into diesel. Even with no change in current pricing conditions, switching to marine gasoil would significantly increase fuel costs for shippers.

As a result, many shippers are looking for alternatives, such as adding on-board exhaust scrubbers or switching to liquefied natural gas (LNG) as a fuel. Installing scrubbers would allow shippers to continue to burn high-sulfur fuel oil (HSFO), though it comes at a high conversion cost both from the capital expense of the scrubber equipment and the lost time in service while the ship is in dry dock. Switching to LNG also incurs some significant up-front costs, but the biggest deterrent thus far has been concern about the availability of LNG as a bunker fuel.

For these reasons, we expect the market to—at least initially—shift to using marine gasoil as the new regulation goes into effect. Based on the resulting impact on prices, we foresee subsequent waves of investment in shipping and refining.

Global Downstream Outlook to 2030

Market impact from shifting from resid bunker to marine gasoil.

As shippers switch from resid bunker to marine gasoil, we expect to see two key changes. First, the higher demand for gasoil will largely have to be met by higher crude runs, putting upward price pressure on global crude prices, distillate premiums to other fuels, and refining margins in general. We estimate that the switch to marine gasoil will add about 1.5 million barrels per day to distillate demand globally, leading refiners to run an additional 2.2 million barrels per day of crude oil through distillation. This should increase refining utilization in the major hub markets by 2.9 to 6.7 percentage points. Margins will rise as a result, with European Brent cracking margins expected to be up $3 per barrel.

This should also tighten distillate markets relative to gasoline, adding to the cost of marine gasoil. Recently, the spread between gasoline and diesel prices has been relatively constant—about $4–$6 per barrel—due to the similar growth rates of the two products. However, history shows that when diesel demand accelerates relative to gasoline, diesel prices shift to premiums of $10–$12 per barrel over gasoline, which we expect to see in 2020 when diesel/gas-oil demand jumps due to the International Convention for the Prevention of Pollution from Ships (MARPOL) (exhibit).

Second, falling demand for high-sulfur fuel resid will cause its price to decline, widening the spread between traditional high-sulfur resid bunker and marine gasoil. In recent years, resid markets have been fairly tight, reflecting resid being valued as a feedstock in marginal refinery-conversion capacity. With an oversupply of resid, the marginal barrel will have to find a home in a lower-valued use.

In the past, such a use has typically been in competition with natural gas in power markets that have the ability to switch to fuel oil. A shift to this level of pricing would widen the fuel-oil spread to Brent from $6 per barrel in 2019 to $20 per barrel in 2020. However, given the volume of excess resid predicted and the fact that it will all be very-high-sulfur material, this could overwhelm the traditional substitution market. If it were to do so, then resid would likely have to find a home competing with even lower-value coal in the Asian power sector, causing HSFO prices to reach as low as $15 per barrel.

Combined, these market effects mean a potential widening of the spread between gasoil and HSFO in the Singapore market from current levels of $20 per barrel to as much as $100 per barrel in the coal-substitution scenario. This would result in refining margins for full-conversion coking/hydrocracking plants going from 2018 levels of $6–$7 per barrel to $30–$40 per barrel.

Under these market conditions, there would be a huge incentive for shippers and refiners to contemplate capital investments to capture value from this spread. To allow shippers to continue using low-cost HSFO, the payout time for scrubber investments on ships would fall to months. For refiners, the expected rate of return for coking and hydrocracking investments would also be huge.

Powered by Energy Insights

Energy Insights’ world-class team of data scientists and analysts leverage data and advanced analytics to power our insights and advise clients across the energy value chain.

Opportunities for different sectors

A market shift of this magnitude creates both threats and opportunities for players across the value chain:

- HSFO marketing. Current producers of high-sulfur bunker fuel will need to look for alternative end uses, but there will be strong competition to capture the opportunities for power generation and other industrial uses. Some end uses—like substitution against direct crude burn and against coal—may currently be considering fuel oil as an option and could become viable should differentials widen significantly.

- Low-sulfur fuel oil blending. If reliable supplies materialize, demand for 0.5 percent resid should grow. Capturing this opportunity will require segregating and aggregating existing volumes of low-sulfur resid material from refiners that are currently feeding it to conversion. This will likely require new commercial agreements and some investment in tankage and logistics.

- Refinery investment. Much wider differentials should make investments in conversion (such as coking) attractive, but the time to capitalize on this opportunity has likely passed, given how long it takes to complete a project. History would suggest that a wave of investments is likely to follow a widening of differentials, but many of the projects will come online too late to capture the full upside potential.

- Bunker-fuel sourcing. Shippers will face a growing array of options for fueling their fleets, including shifting to marine gasoil, sourcing low-sulfur resid, and investing in scrubbers or LNG. Making the right move at the right time should have big economic consequences.

This article appeared in the September 2018 edition of Tank Storage Magazine and is reprinted here by permission.

Emily Billing is an analyst in McKinsey’s Houston office, where Tim Fitzgibbon is a senior expert and Anantharaman Shankar is a consultant.

Explore a career with us

Related articles.

MARPOL implications on refining and shipping markets

MARPOL uncertainty not stopping some refiners from acting

Surge in global refinery additions could cut margins in 2019

Fuelling Superyachts around the world

With over 30 years of experience supplying fuel to luxury yachts, we deliver the highest quality marine fuels at competitive prices, with outstanding levels of service.

Comprehensive network

A vast network of suppliers with reach to over 1000 ports and marinas worldwide.

100% independent

We are proud to be privately owned by our directors and care about our customers.

Competitive pricing

We always strive to offer the best possible prices without compromising on service or quality.

Why choose Revolution Fuel as your yacht fuel supplier

Worldwide coverage.

The highest quality marine fuels for yachts at marinas, ports and anchors throughout the world.

Revolution Fuel supply yachts at thousands of delivery locations around the world and works with countless port agents and local representatives to provide flawless all-encompassing service.

Outstanding service

Detailed and useful information for all aspects of your fuel delivery from clear pricing and product specifications to procedures, formalities and calling instructions.

- Detailed product analysis

- Tax breakdowns

- Tax exemption information

- Logistics and timing

Attention to detail

Even the smallest details are important when it comes to making a delivery that is as smooth and efficient as possible. That is why we provide clear and comprehensive information surrounding all aspects of your fuel delivery.

Decades of experience

Revolution Fuel has over 30 years of experience supplying fuel to luxury yachts the world over.

With our head office located in London we are ideally placed to negotiate with suppliers throughout the world.

Here to help 24/7

Available to help you 24 hours a day, 7 days a week.

On call for short notice and emergency fuel requirements.

Competitively priced fuels and lubricants

Your expert fuel partners

Barnaby Skipwith

An expert and leader in the field of superyacht fuelling, Barnaby is highly respected by those who require technical expertise, precise communication and an exceptional standard of professionalism. His understanding of detailed technical specifics, in addition to his ability to provide comprehensive worldwide logistical and regulatory information, guarantee an unparalleled, individualised and tailored global service.

John Sipson

With over a decade of outstanding service within the global yacht fuel industry, John has amassed a wealth of technical skill and extensive logistical knowledge, in addition to the expertise required to provide a high end service for the most discerning of clients. John's professionalism, technical knowledge and dedication to achieve the best solutions for his clients on every occasion is highly regarded and trusted.

What our clients are saying about us

"I have used John Sipson and Barney Skipwith of Revolution Fuel globally and I find them faultless!"

"I have used Revolution Fuel for years. Always well organised, quick and convenient. The service is good and the prices have been excellent"

"I have relied on John and Barnaby now at Revolution Fuel for as long as I can remember"

Top quality fuels and lubricants. Anywhere in the world

Make a fuel enquiry or give us a call today

Our Solutions

Streamline bunkering with effective fuel management Why pay more? We can help you reduce costs. We offer start-to-finish fuel management that makes it easy, from procurement to inventory management and delivery options.

Fuel your fleet at strategic physical supply locations

Manage your budget with cost-effective lubricants, outsource fuel procurement for less headaches, be more efficient with technology that works, world fuel services strengthens commitment to industry collaboration with key cimac appointment.

May 30, 2024 – Miami – World Fuel Services (World Fuel) announces that John Stirling, the company’s Director, Marine Technical, has accepted a key position at CIMAC, the International Council on Power, Drives and Propulsion. He will take over the vacant position of Secretary of CIMAC’s WG7 working group. The association has recently refocused from providing a technical forum for conventional diesel engine expertise, to include all new types of energy, and is now a fully pledged alternative energy association, covering innovation and best practices in power, drives and propulsion. World Fuel is committed to fostering collaboration to drive development and sustainability throughout the marine industry, and this appointment further emphasizes this commitment.

Transactions

Global Sea Ports

Billion Gallons

* Figures as of December 31, 2020

Why Partner With Us

|

|

Featured Content

Expansion of Strategic Partnership with Shell Marine Lubricants

Mass Flow Metering - Going With The Flow

Bunker Fuels: The benefits of working with a strong counter party

- Marine General Terms and Conditions

- ISO Standards

- Website Terms and Conditions

- Privacy Center

- Cookies Policy

- UK Modern Slavery Act

©2024 World Kinect Corporation. All rights reserved.

Pioneering next wave fuel solutions

We are Dan-Bunkering, a global leader in fuel solutions for the maritime industry. With more than 40 years of experience, 90 international fuel suppliers across 11 offices, we’re committed to pioneering the next wave of fuel solutions together with our customers and partners.

Looking for a fuel solutions expert?

SELECT OFFICE

Related insights

Meet us at Seatrade Cruise Med in Malaga, 11-12 September 2024

Aug. 30, 2024

Dan-Bunkering continues to deliver strong results

Jul. 09, 2024

Webinar September 24, 2024: FuelEU Maritime: Background and regulatory overview

Extensive experience across industries, container vessels.

We know that on-time refuelling is key to meeting tight time schedules. By focusing on an in-depth understanding of the industry, we help you transport containers from one port to the next.

Bulk vessels

Operating bulk vessels often takes you to remote locations and you might not even know where you are going next. We are here to help you navigate uncertainty in shipping routes, price volatility and different local procedures to secure optimal operations.

Tanker vessels

Tanker vessels operate under short and complicated supply windows. We understand the importance of ensuring a timely and flexible delivery of fuel. And we are dedicated to assisting your business on achieving optimal operations.

We know that yachts are nothing like the ordinary shipping business. We focus on supplying high-quality fuel to yachts at anchor in remote destinations or along the quay in busy ports, providing convenient pricing models.

Nothing should stop your passengers from getting an experience of a lifetime and ensuring on-time departure and arrival is a crucial aspect of tourism operations. We provide spot and contract fuel solutions that support ferries, cruises and tourism companies throughout every step of their scheduled activities.

Fishing vessels

We understand the need to keep operations running, even when seas are rough. And that often includes fast and flexible refuelling on location. Through our extensive bunker locations, we are ready to supply your vessel, wherever you may be located.

The construction of new offshore wind farms, oil exploration and other offshore projects requires a holistic understanding. We provide end-to-end solutions and advice – from planning to installation.

Pioneering the next wave of fuel solutions

Our company.

Dan-Bunkering was founded in 1981 with the mission to pioneer the bunker trading business and fuel solutions for the maritime industry. And we have specialised in providing our customers with high-quality bunker fuel, lubricants, and other vessel services ever since.

Global presence meets local know-how

years of experience

fuel solution experts

local offices

Are you taking advantage of price volatility?

Volatility in prices, changes in regulations, supply chain shocks and geopolitical tensions have turned the bunker fuel market into a highly dynamic and rapidly changing industry.

Are you ready to establish safer industry standards?

On-going sanctions and geopolitical conflicts increase the complexity of dealing with risks and compliance in the maritime industry.

Are you taking action to decarbonise our industry?

As the maritime industry is faced with new legislative mandates to reduce C02 emissions, we experience an increasing demand for new and more alternative fuel solutions.

Looking for new ways to optimise operations?

The maritime industry continues to advance with new technological developments emerging every day. Yet, traditional operational issues persist – and your operations and refuelling have to be coordinated accordingly.

- Agile pricing and financing

- Safe trading

- Alternative fuels and CO2 reductions

- Smarter operations

Join us in shaping the future of fuel solutions

We continuously work to innovate and navigate the latest challenges in our industry. To do so, we are always on the lookout for the best talents to bring new perspectives on board.

Let’s find the right person for you

Our dedicated teams of experts always strive to find the optimum solution for you.

* required fields

Thank you for your request!

A fuel solution expert will contact you shortly. For immediate assistance, call our Head Office available 24/7 at +45 6441 5401.

You can read about our collection and storage of your personal data in our Privacy Policy.

PROVIDING YACHT SERVICES

Experience you can trust.

DISCOVER THE DIFFERENCE

How can we help you?

We’re here to make your life easier. Whether that’s helping plan the most cost-effective route in terms of available fuel, or sourcing the best quality product at the most competitive rates, our aim is to be the best in the business.

MARINE FUEL

MARINE LUBRICANT

See the areas we cover

Peninsula is the world’s leading independent marine energy provider. We have our own physical supply capabilities in 12 locations around the world and an extensive global network of carefully vetted supply partners to provide you the best service wherever you might be cruising.

We are Peninsula

Pushing the industry towards a more sustainable future.

Our guiding purpose is to lead the marine industry’s transition to a more sustainable future, providing a variety of cleaner energy solutions in a responsible way.

Latest News & Events

27 August 2024

The Environmental Advantages of Sustainable Yacht Fuels

In recent years, the yachting industry has witnessed a paradigm shift towards sustainability. Yacht owners and operators are increasingly aware of the environmental impact of traditional fossil fuels and are...

20 August 2024

Top Tips for Efficient Marine Fuel Usage

In yachting, fuel costs account for a significant portion of operating expenses. With the rise in fuel prices and increasing environmental regulations, efficient fuel usage has become more critical than...

09 July 2024

Advancements in Marine Fuel and Energy

Over the years, the marine fuel sector has experienced significant advancements, driven by a growing need for sustainability and efficiency. At Peninsula, we are at the forefront of these advancements,...

05 July 2024

Marine Energy Services and Solutions with Peninsula

With over 25 years of expertise, at Peninsula, we have established ourselves as a global leader in the marine energy sector. As a physical distributor and reseller of marine fuel,...

29 May 2024

Using Red Diesel for Yachts in Line with Regulation

Get in touch today.

Whatever your enquiry is about, our team are happy to help.

- Quality Control

- Sustainability

- News & Events

© 2024 Peninsula Yacht Services. Terms of Use Privacy Policy Cookie Policy

Website design by Piranha Designs

The global authority in superyachting

- NEWSLETTERS

- Yachts Home

- The Superyacht Directory

- Yacht Reports

- Brokerage News

- The largest yachts in the world

- The Register

- Yacht Advice

- Yacht Design

- 12m to 24m yachts

- Monaco Yacht Show

- Builder Directory

- Designer Directory

- Interior Design Directory

- Naval Architect Directory

- Yachts for sale home

- Motor yachts

- Sailing yachts

- Explorer yachts

- Classic yachts

- Sale Broker Directory

- Charter Home

- Yachts for Charter

- Charter Destinations

- Charter Broker Directory

- Destinations Home

- Mediterranean

- South Pacific

- Rest of the World

- Boat Life Home

- Owners' Experiences

- Conservation and Philanthropy

- Interiors Suppliers

- Owners' Club

- Captains' Club

- BOAT Showcase

- Boat Presents

- Events Home

- World Superyacht Awards

- Superyacht Design Festival

- Design and Innovation Awards

- Young Designer of the Year Award

- Artistry and Craft Awards

- Explorer Yachts Summit

- Ocean Talks

- The Ocean Awards

- BOAT Connect

- Between the bays

- Golf Invitational

- BOATPro Home

- Superyacht Insight

- Global Order Book

- Premium Content

- Product Features

- Testimonials

- Pricing Plan

- Tenders & Equipment

Future fuels: Is the industry doing enough and what are the alternatives?

The yachting industry has got by with conservative tweaks to diesel-based engines for years, but now, time is up. As the industry prepares to come together at the 2022 Superyacht Design Festival to discuss potential solutions, BOAT outlines the options facing builders and owners today in the face of tough new emissions targets...

The yachting industry needs a revolution. It’s currently attached to the status quo – twin diesel engines, shafts and propellers (and variations thereof) are still the norm. Why? Diesel is a widely available fuel that packs the most bang for its buck, and private yachts use some of the “cleanest” diesel available in finely tuned engines, is a typical answer. Is it true? Essentially yes, says Martin Richter, Ship Type Expert, Yacht, for classification society DNV GL. “These are cleaner solutions and state-of-the-art engines – [although] they still burn conventional fossil fuels.”

But better naval architecture, increased efficiency and finely tuned engines won’t suffice to meet decarbonisation goals. “To comply with the IMO’s level of emissions, improving efficiency will not be enough. We will have to go through a propulsion revolution, which means new fuels,” says Lorenzo Pollicardo, technical & environmental director for the Superyacht Builders Association (SYBAss).

Among problematic emissions, including carbon dioxide (CO2) and sulphur oxides (SOx), nitrogen oxides (NOx) have been in the forefront in recent years because of a 2021 deadline that mandated the maritime industry come up with solutions to reduce NOx output.

“Yachts don’t emit a lot of sulphur, but that leaves other emissions,” says Robert van Tol, executive director of the Water Revolution Foundation, which is attempting to provide the first comprehensive guide that defines the yachting sector’s environmental impact. “The SCR [selective catalytic reduction] system – which injects a urea solution into exhaust – is trying to tackle NOx.” However, it’s bulky, cumbersome and only effective at high temperatures, so the industry is looking for other solutions that will help meet regulations without reinventing the engine room.

Another reason for conservative thinking is safety. “Naval architects are risk-averse,” says Jorden Kemper, founding partner at Zero Emission Advisors, a consulting company based in San Francisco that advises industries on hydrogen solutions. “[They are about] safety engineering and compliance.” And they are not the only ones. Classification societies, brokers and buyers also gravitate toward proven solutions. Finally, for builders and shipyards it makes sense financially to choose incremental improvements (for example, better engines, variable-speed generators, heat recovery systems, batteries for peak shaving or better stabilisers) over radical changes. “Manufacturers have billions of dollars-worth of production lines based on the conventional system. Will they simply dump their investments? I don’t think so,” offers a naval architect and engineer working in Turkey.

- What the IMO's new cyber security requirements mean for superyachts

Improvements are possible, including in the yacht’s most fundamental characteristic, its naval architecture – especially since computational fluid dynamics (CFD) analysis has made the modelling of hulls quicker and more affordable. Take the Hull Vane, an underwater appendage that acts a bit like a spoiler on a car to improve efficiency. Heesen’s first installation on 42-metre Alive (now Ares )yielded a 20 per cent fuel saving in “the yacht’s useful speed range”. This result is consistent with a case study on a 52-metre offshore patrol boat retrofit. Fuel consumption was reduced by 18 to 27 per cent, depending on speed. Increased stability and less fuel also mean fewer emissions (and increased comfort).

Fuel for thought

Although seldom discussed in yachting circles, bio and synthetic fuels offer great benefits because they work with current combustion engines and have far fewer emissions. In the US, Gevo makes fuel, essentially, from carbohydrates. It currently focuses on jet fuel and gasoline (Isobutanol made from corn), which the National Marine Manufacturers Association (NMMA) has endorsed for use as a blend in boat engines in the US. If the demand is there, Gevo can also produce biodiesel for maritime use.

Rolls-Royce (which owns engine maker MTU) sees these types of fuels as a good transition solution. “Short- to medium-term options are synthetic diesel fuels, [such as] the second generation of bio-based fuel like HVOs [hydrotreated vegetable oils], and in the longer term we believe there will be a transition to e-fuels [synthetic fuels produced by electrolysis],” says Daniel Chatterjee, head of Exhaust Gas After-treatment & Green & High-Tech Programme at Rolls-Royce Power Systems. “Our modelling sees that the major take-up for renewable fuels made from electricity will be after 2030. Until then, we will see those bio-based fuels.” Because engines can work with synthetic and conventional diesel indiscriminately, availability will not be a problem, even for long-distance cruises, making them an attractive intermediate solution.

Why won’t incremental changes suffice?

For better or worse, large yachts are considered part of the maritime community and have to comply with international conventions, says Pollicardo. Driving change in the maritime world is the IMO’s 2018 adoption of greenhouse gas emission reduction targets. “The real objective is to reduce the total greenhouse gas emissions by at least 50 per cent by 2050,” he says, with full decarbonisation by 2100.

Combustion engines have had more than 100 years of refinements and are very good at converting fuel into mechanical energy. “[But] when you are at 40, 45, 50 per cent (thermal) efficiency, you reach a point where you can’t make the engine significantly more efficient,” says Kristian Holmefjord, executive vice president and project director–fuel cells for Corvus Energy.

IMO’s 2018 resolution also implemented an Energy Efficiency Design Index (EEDI) that requires a minimum energy efficiency level per capacity mile for new ships, and Pollicardo says it’s essential for the yachting industry to come up with facts and figures relevant to private yachts to help tailor these regulations. For instance, ships have regular routes and predictable speed and behaviour, while SYBAss has calculated that yachts operate an average of 400 to 500 hours a year. This means that solutions devised for the shipping industry will not necessarily translate to yachts, and vice versa. Besides, “There is no comparison between the economic model of yachts and the shipping industry,” says Laurent Perignon, who advises Energy Observer Developments (EODev), an R&D firm working on speeding up the energy transition.

There is also the matter of public image. Who wants to be seen as having wanton disregard for a global environmental problem? Yacht owners don’t. Lennart Pundt, head of project development for Lürssen , sees a parallel between new designs that place the lifestyle close to the water and an “increased awareness and care about environmental responsibility. The mindset is changing,” he says.

What are the current options?

The time has not yet come to ditch the combustion engine. It will play a role for up to 50 years, Homelfjord says, but a transition is happening with many taking a look at re-emerging fuels (for instance, hydrogen, ammonia or synthetic diesel) and new power conversion solutions. A common thread is electrification through fuel cell and battery technologies.

“There are currently more than 500 hybrid or purely electric ships of all kinds either in service or under construction. What is truly impressive about this number is the fact that it has grown from practically zero over as little as five years,” says DNV’s Richter.

Whether going hybrid is currently a “green” solution is hotly debated and it’s nearly impossible to quantify fuel (and emissions) savings because yachts have such different operating profiles. “We do not have any numbers to show that diesel-electric hybrid systems are better or worse in terms of their fuel efficiency,” Richter says, “but they have a number of advantages over conventional engines” – reduced noise and increased comfort.

The best way to do that would be to equip two identical yachts with hybrid and conventional propulsion systems, access their data, and compare their fuel consumption over time. Tankoa comes close to this scenario, having equipped its 50-metre aluminium platform with both conventional and hybrid systems.

The shipyard worked with E-Motion on the parallel hybrid system installed on the World Superyacht Award-winning 50-metre Bintador . The set-up combines two diesel engines (with maximum rated power of 895kW), generators and electric engines. Good management is key of course, but the shipyard’s technical director, Andrea Parodi, says that in the range of 15 to 17 knots and using the shaft alternator option (diesel engines on, generators off and electric motors producing electricity) it’s realistic to expect to save 15 to 20 per cent in fuel consumption and extend the range from 4,000 to 4,400 nautical miles. This platform, he says, is well suited to hybrid because “the hull is very efficient in low-speed conditions, seven to 11 knots, and does not need a lot of power to start moving.” It takes two small generators (500kW) and electric motors to run the yacht up to 11 knots and keep all the lights on. An in-build hybrid yacht at Tankoa will also have a zero-emission mode.

With the introduction of improvements such as variable-speed generators and energy-dense batteries, the range of potential applications has grown significantly since 2006 when the founder of E-Motion, Michele Maggi, worked with Ferretti on the first hybrid system to be fitted on a motor yacht (a 23-metre Mochi Craft). Maggi sees perfect applications on everything from 30-metre planing yachts to sportfishers, which can charge batteries while heading to their fishing grounds, then trawl for hours on electric power, with savings of up to 30 per cent in fuel and emissions, he says. And thanks to the fast progress in batteries, it’s only going to improve. E-Motion currently works with shipyards in the US and Italy, including Azimut-Benetti, for whom it is developing hybrid solutions for several models in the builder’s semi-custom lines.

In the superyacht segment, Benetti has already implemented hybrid solutions from relatively simple systems (an additional electrical input on a shaft line, for example) to diesel-electric systems with Azipod propulsion – the 107.6-metre Luminosity , for instance. The giant yacht’s 3,000kW battery bank can power the hotel load for 12 hours.

Most, if not all, superyacht builders have delivered or are working on hybrid projects. At the same time, more companies are developing hybrid systems, including Rolls-Royce, which already offers custom solutions and is working on the 2022 release of a turnkey system suitable for yachts 30 metres and up. MTU’s neighbour, ZF, which is known to the yachting world for its transmissions, is working on a power-take-in (PTI) solution that allows plugging in an auxiliary electric motor.

Diesel-electric

ABB Marine & Ports, which has already fitted several Azipod-driven superyachts, including Luminosity and the 80-metre Nobiskrug Artefact , has recently struck an agreement with Ballard Power Systems to speed the development of fuel cell-based solutions for the maritime industry.

Right now, the company posits that electrically driven propulsion (Azipods) is the best way to go. Why? Diesel engines on yachts seldom operate at their peak performance, particularly in slow manoeuvres. “A superyacht’s engines are typically rated for a maximum vessel speed of, say, 18 knots, but the yacht may for a significant part of its life idle around at speeds between nine and 12 knots,” says Riccardo Repetto, global segment manager, yachts at ABB Marine & Ports. “Apart from reducing fuel efficiency, operating at lower loads increases exhaust emissions, generates particles and soot and shortens the service intervals of the engine.” He adds that electrical propulsion is much more efficient and a solution such as electric Azipods “further increases fuel efficiency through electric and gearless thrust, as well as through the reduced vessel hull resistance”.

- Luminosity: On board Benetti 108m hybrid superyacht

Other benefits include comfort at anchor and underway and flexibility in design on large yachts. “The electrical power and propulsion plant in its many shapes forms the platform in the development towards zero emissions,” says Thomas Hackman, market development manager for yachts at ABB.

Again, numbers are not readily available due to the individual operational profile of each yacht, but a diesel-electric system, such as the one fitted on Artefact , offers great flexibility and the ability to fine-tune power needs. Artefact can cross the Atlantic with just one diesel engine; one generator suffices to power the house and propulsion pods at cruising speed, plus she can cover short distances on batteries alone, which all add up to less fuel consumption and reduced emissions. After a few months of running the yacht in various conditions, including a transatlantic crossing, Artefact ’s captain, Aaron Clark, estimated diesel fuel savings to be 20 to 30 per cent, depending on the operational mode. In the future, elements of Artefact’ s hybrid propulsion system can be changed to newer solutions, including fuel cells.

Ivo Veldhuis, co-founder of superyacht consultancy Mayfair Marine, also says diesel-electric is a giant step forward. “You have the opportunity to change the way you generate power – part batteries, part engines – and you can decide to run those engines either on diesel, liquid natural gas [LNG] or even ammonia to reduce environmental impact and emissions.”

This does not take care of all CO2 emissions, and LNG is only considered an intermediate solution since it is a fossil fuel, but such systems can be built (as it was on Artefact ) for eventual upgrades to fuel cells that use methanol or liquid hydrogen when that becomes more feasible. “The key element is the electric propulsion plant,” says Veldhuis.

- Artefact: On board Nobiskrug's striking 80m hybrid superyacht

A fossil-free future?

This unavoidable goal is driving many to explore all solutions, including hydrogen. In 2019, Sinot Yacht Architecture & Design and Lateral Naval Architects made a big splash with a concept presented at the Monaco Yacht Show for a 112 metre called Aqua that integrated a 28-tonne capacity liquid-hydrogen system powering PEM (polymer electrolyte membrane) fuel cells. This concept, as well as pilot projects such as Energy Observer , a zero-emissions energy self-sufficient catamaran that uses hydrogen, wind and solar as its only power sources to go around the world, have helped revive the hydrogen discussion.

Hydrogen has many virtues: it is the most widely available molecule in the world; it is carbon free, energy dense and its only byproduct is water. Seems like a dream? Maybe.

“Hydrogen has got this habit of making false starts. Everybody thinks, it’s going to happen. And then it doesn’t,” says Veldhuis, who wrote his doctoral thesis on the application of hydrogen to marine systems and helped set up Hydrogen Europe’s maritime working group.

One issue with hydrogen is storage. In gas form it’s very voluminous and tends to spook people based on safety, and in liquid form it needs to be kept at very low temperatures and requires roughly four times the space of diesel. That does not stop superyacht builders (and classification societies) from investigating options.

Hydrogen use requires extensive modifications of the yacht, says Bram Jongepier, a senior specialist with Feadship’s De Voogt Naval Architects, adding, “We know – we are building one.” However, he describes this zero-emission solution as best for “the purist” and says that “a partial range on hydrogen is a smart solution”. An early adopter of synthetic fuels, Feadship deems them (specifically HVO) “most suitable for retrofitting” with few modifications and a substantial reduction in emissions. Jongepier says methanol’s availability and pricing gives it the edge and may push it into “a dominant position”. Despite the shortcomings of existing solutions, it is possible to build a fossil-free yacht now, he says, “if the owner really wants it”.

And owners do want it. Just before this issue of BOAT International went to press, Lürssen announced it had received its first order for a yacht with fuel-cell technology. The company was working on this development as part of a consortium of German builders. “We feel comfortable putting this technology on board,” says Björn Berndt, who is part of the project development team. However, Lürssen is looking at more widely available energy carriers, such as green methanol or ammonia.

“With hydrogen, you really have a range issue,” Pundt says. “The handling is complicated, and the space requirement is in areas of the vessel where you usually have dry storage, freezers, laundry and is quite valuable space.” And then “you lose the greatest benefit that you have for a yacht, that you are independent, that you can travel wherever you want, to the most remote and beautiful places where there is no hydrogen supply chain”.

While it has its limitations, methanol is easier to handle and has higher energy density than hydrogen, so Lürssen has built a testbench to prove its methanol fuel cell and auxiliary systems under realistic conditions. The recent sales announcement will shorten the timeline for the first application, which Pundt had said would be within five to 10 years.

Methanol is sulphur-free and has low overall emissions, although in that respect, it is not the dream scenario that green hydrogen represents – no emissions other than water.

Don’t forget about sails

“The first fossil-free yacht should be a sailing yacht,” says naval architect Philippe Briand, just as the first hybrid superyacht was a sailing yacht – Royal Huisman’s 58-metre Ethereal , delivered in 2008. Briand’s studio recently released a concept for a 63-metre, 490-gross-tonne fossil-free sloop with an efficient hull form, 20 tonnes of batteries and underwater turbines to generate 500kW at 20 knots. Whether sail or power, Briand believes hydrogen can play a supporting role in yachting and he has a solution ready for the 50-metre Vitruvius Exuma to generate hydrogen on board. “We made a whole study, and it is completely doable, particularly for this yacht that has a generously sized garage,” he says. “It is a wonderful solution. While we don’t promise to generate enough power for the propulsion, it would be sufficient for the hotel load.”

The self-sufficient, floating laboratory Energy Observer combines the hydrogen it generates on board with solar and wind power to provide for all its energy needs. To harness wind power, it switches from wind turbines to wind propellers, known as wings. These have also caught the attention of the developers of the Merveille concept, a superyacht that combines renewable energies (like the sun and wind) with small combustion engines. The solutions, says Merveille Yachting CEO Nicolas Cantenot, are “simple, reliable and doable”. Wings can be seen as motors that work with the wind, twice as efficient as regular sails, which allows reducing the size of the combustion engines on board.

“Even on a sailing yacht you need a diesel engine,” says EODev’s Perignon. “The best option now is the combination of solutions, and engineering [the yacht] so that you can adapt to the accelerating technologies that are emerging.”

There may not be a consensus on how to reach the goal of fossil-free yachting in the future, but electrification holds the keys to a better lifestyle on board and opens the door to technology such as fuel cells. Kilowatts, it seems, will be the new knots.

The 2022 Superyacht Design Festival will be a summit on the power of responsive design and its role in yachting today. This year's event will be held in Milan from 22-24 June. Tickets are still available to purchase .

More about this yacht

Yachts for sale, more stories, most recent, from our partners, sponsored listings.

| ISOindustries, Inc. |

- Robert Powell | [email protected]

- Mathew Lipkin | [email protected]

- Karen Dzupinka | [email protected]

- Stephanie Collier | [email protected]

- Kevin Gudejko | [email protected]

- Mike Sano | [email protected]

- Robin Brown | [email protected]

- Thomas Powell | [email protected]

- Samantha Powell | [email protected]

- Samantha Powell | [email protected]

- Mike Sano | [email protected]

- ISOindustries Corporate

- ISObunkers VA

- Global Yacht Fuel

- Climate modelling

- Extreme weather

- Health and Security

- Temperature

- China energy

- Oil and gas

- Other technologies

- China Policy

- International policy

- Other national policy

- Rest of world policy

- UN climate talks

- Country profiles

- Guest posts

- Infographics

- Media analysis

- State of the climate

- Translations

- Daily Brief

- China Briefing

- Comments Policy

- Cookies Policy

- Global emissions

- Rest of world emissions

- UK emissions

- EU emissions

- Global South Climate Database

- Newsletters

- COP21 Paris

- COP22 Marrakech

- COP24 Katowice

- COP25 Madrid

- COP26 Glasgow

- COP27 Sharm el-Sheikh

- COP28 Dubai

- Privacy Policy

- Attribution

- Geoengineering

- Food and farming

- Nature policy

- Plants and forests

- Marine life

- Ocean acidification

- Ocean warming

- Sea level rise

- Human security

- Public health

- Public opinion

- Risk and adaptation

- Science communication

- Carbon budgets

- Climate sensitivity

GHGs and aerosols

- Global temperature

- Negative emissions

- Rest of world temperature

- Tipping points

- UK temperature

- Thank you for subscribing

Social Channels

Search archive.

Receive a Daily or Weekly summary of the most important articles direct to your inbox, just enter your email below. By entering your email address you agree for your data to be handled in accordance with our Privacy Policy .

- Analysis: How low-sulphur shipping rules are affecting global warming

Multiple Authors

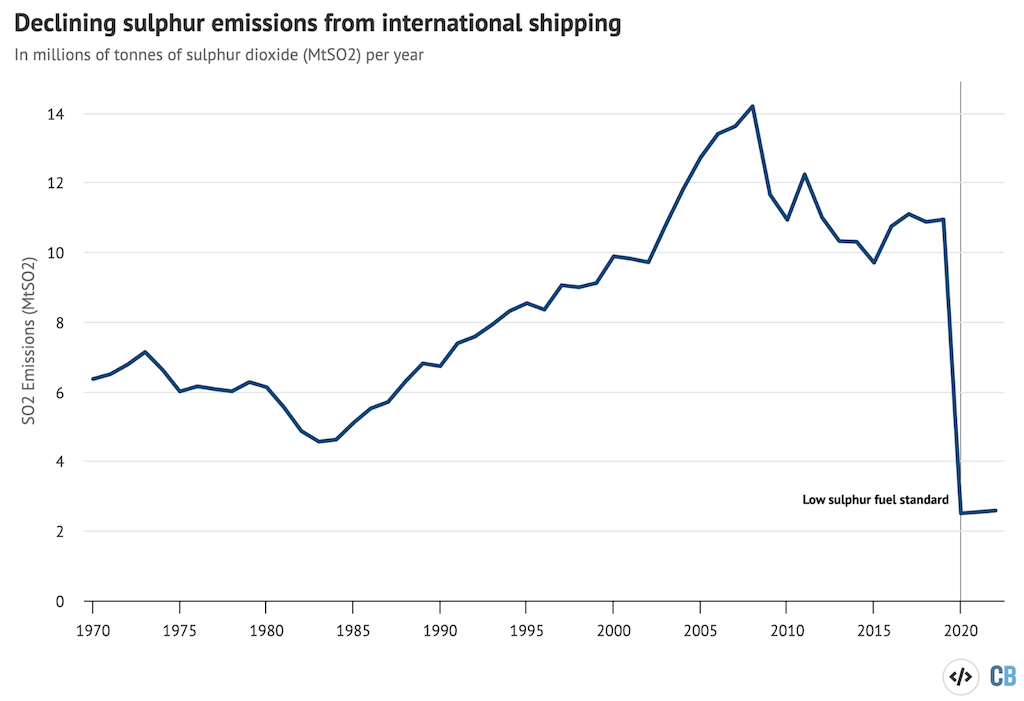

In 2020, international regulations to reduce air pollution from shipping imposed strict limits on the sulphur content of marine fuels.

The International Maritime Organization ( IMO) rules have had some success in improving public health. Global emissions of sulphur dioxide (SO2) – a health-damaging air pollutant – have dropped by about 10% as a result.

But the shift to low-sulphur shipping fuel has had an additional consequence.

Sulphur particles contained in ships’ exhaust fumes have been counteracting some of the warming coming from greenhouse gases. But lowering the sulphur content of marine fuel has weakened the masking effect, effectively giving a boost to warming.

Some researchers have proposed that the drop in SO2 as a result of the IMO’s clean air regulations could be behind a recent spike in global sea surface temperature.

Carbon Brief analysis shows that the likely side-effect of the 2020 regulations to cut air pollution from shipping is to increase global temperatures by around 0.05C by 2050. This is equivalent to approximately two additional years of emissions.

While this will contribute to warming and make it even more difficult to avoid exceeding 1.5C in the coming decades, a number of other factors are likely contributing to the ocean heatwave.

These include a massive eruption of an underwater volcano in the south Pacific, an unusual absence of Saharan dust and a growing El Niño .

Phasing down

Nearly all SO2 emissions today are a by-product of fossil fuel combustion.

Globally, SO2 emissions from marine fuel increased from around 6 million tonnes (MtSO2) per year in the 1970s to more than 10MtSO2 per year in the 2000s and 2010s.

SO2 emissions from fossil fuels have long contributed to severe health impacts through the formation of particulate matter known as PM2.5 .

Studies estimate that the high sulphur content of marine fuel – which is much higher than levels allowable on land – contributes to between 19,000 and 91,000 premature deaths each year in coastal regions.

Scientists have long included a gradual phaseout of SO2 emissions in climate models as the world transitions away from fossil fuels.

Nearly all emissions scenarios assessed in the recent Intergovernmental Panel on Climate Change’s Sixth Assessment Report ( AR6 ) expect SO2 emissions to decline in the future. The decline in SO2 is faster in scenarios where fossil fuels are phased out more rapidly.

In 2020, regulations introduced by the IMO imposed strict limits on the sulphur content of marine fuels. The new rules lowered the maximum percentage of sulphur from 3.5% to 0.5% for all ships operating worldwide.

This followed a more limited restriction in place between 2010 and 2015 that only applied to ships operating around the coasts of North America and the North Sea.

The rapid phaseout of sulphur in marine fuels likely reduced global SO2 emissions from marine fuels by around 8.5MtSO2 per year, to around 2.5 MtSO2 per year. This represents an abrupt decline in global SO2 emissions of around 10% after 2020.

In this analysis, Carbon Brief estimates post-2020 SO2 emissions based on the projected impact of the low-sulphur fuel regulations, as the global aerosol dataset ( CEDS ) is only updated to 2019.

It is possible that compliance with the regulations has not been universal and that the adoption of low-sulphur fuel might be slower than this analysis assumes.

That said, studies undertaken after the phaseout show a strong reduction in measurable ship tracks that occur due to the effects of SO 2 on cloud formation. The authors attribute this to the more stringent ship emission regulations since 2020.

Potential culprit

SO2 has a strong cooling effect on the climate, both through directly reflecting incoming sunlight and by acting as cloud condensation nuclei . This increases the formation of reflective clouds.

Given the strong cooling impact of SO2, a 10% reduction in emissions of SO2 will result in additional global warming.

In recent weeks, there has been a huge amount of attention surrounding record sea surface temperature (SST) globally, with some suggesting that the phaseout of sulphur in marine fuel could be a major driver of the warming.

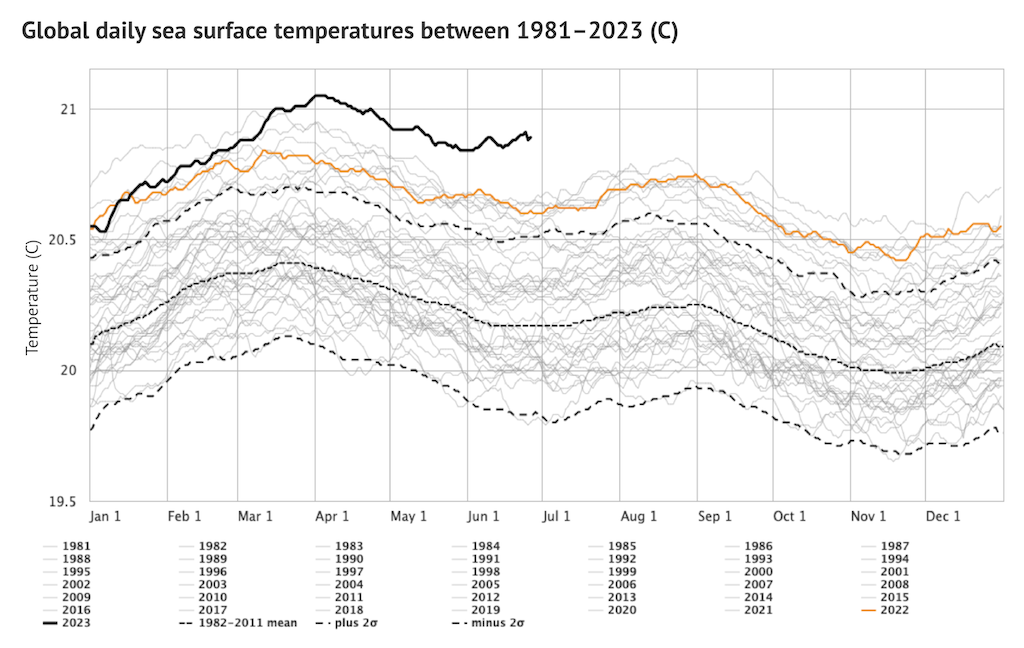

The figure below shows global SST from the US National Oceanic and Atmospheric Administration ( NOAA ) Optimum Interpolation SST ( OISST ) dataset for each year since 1981. The current year, 2023, is shown by the solid black line.

Current SST is around 0.2C above the prior record for this time of year, set last year in 2022.

Exactly how much additional warming will result from a 10% reduction in SO2 emissions is a challenging question to answer.

This is due to large differences between models in their estimates of both radiative forcing from SO2 (and other aerosols) and how sensitive the climate is to changes in forcing.

Radiative forcing is a measure of the combined effect of greenhouse gases, aerosols and other factors that can influence climate to trap additional heat.

Climate impact

In general, SO2 emissions have a larger climate impact in regions where less is emitted. This is because the effects of sulphur particles on cloud formation saturate after a certain point, such that additional emissions have a smaller effect.

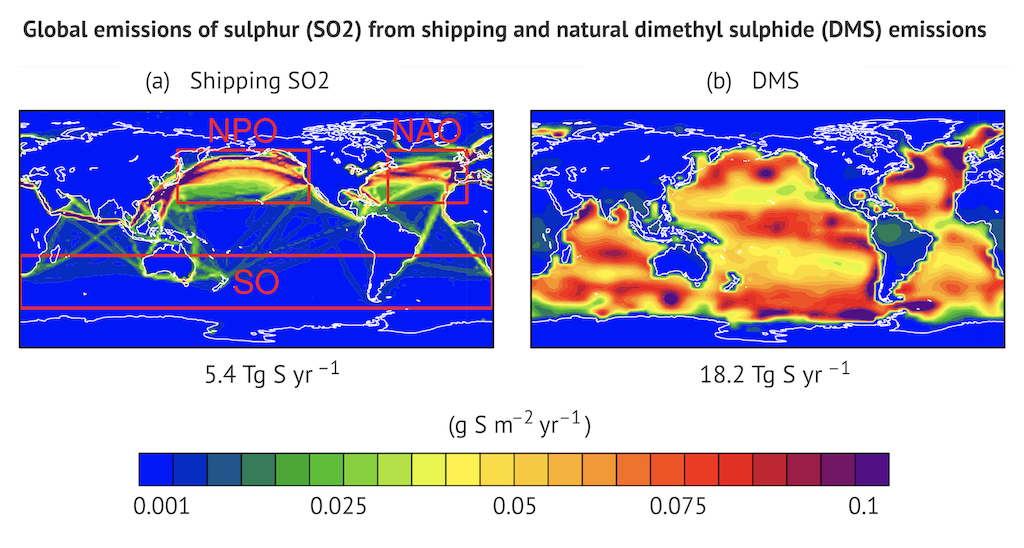

The figure below shows the location of SO2 emissions from marine fuel prior to the IMO regulations in 2020 (left) and the pattern of natural dimethyl sulphide (DMS) emissions, which are primarily emitted by algae (right).

The largest warming impacts are expected where high SO2 emissions from marine fuel overlap with lower DMS emissions. Both areas of high shipping track concentrations (North Atlantic and North Pacific) also have high DMS levels.

To estimate the likely climate impacts of regulations limiting the sulphur content of marine fuel, Carbon Brief calculates the effect of reducing global SO2 emissions by 8.5MtSO2 per year compared to the same climate scenario without those SO2 emission reductions.

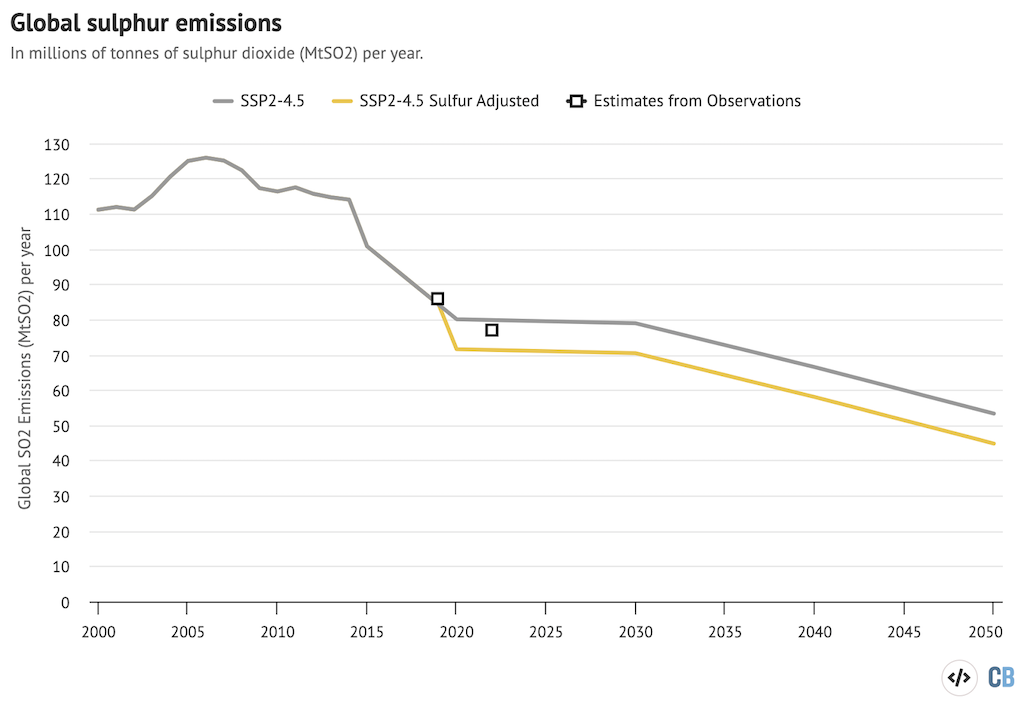

The figure below shows historical SO2 emissions up to 2015 and projected SO2 emissions up to 2050 in SSP2-4.5 , a middle-of-the-road scenario that is broadly consistent with the emissions pathway the world is following under policies in place today (light grey).

The same scenario with reduced SO2 emissions is shown alongside (yellow). Black squares represent two observational data points for SO2 emissions in 2019 and 2022 from Forster et al (2023) .

It is worth noting that the observational estimates of SO2 represented by the black squares above do not explicitly model the effects of the IMO regulations, but include some observations that may overlap with the regulation effects. This may be reflected in the difference between the 2022 observational estimate and the sulphur-adjusted SSP2-4.5 scenario above.

There is also a risk of double counting SO2 reductions over longer time horizons. Some reduction in SO2 from shipping might be expected to occur even in the absence of the 2020 regulations as the shipping industry – and the world more broadly – decarbonises.

In this case, the two scenarios on the figure above would converge towards the upper (grey) scenario over time.

Forcing a change

Using a simple climate model – the Finite Amplitude Impulse Response ( FaIR ) model – this analysis compares the change in radiative forcing between the two versions of the SSP2-4.5 scenario, with and without a reduction in SO2 emissions of 8.5MtSO2 per year after 2020.

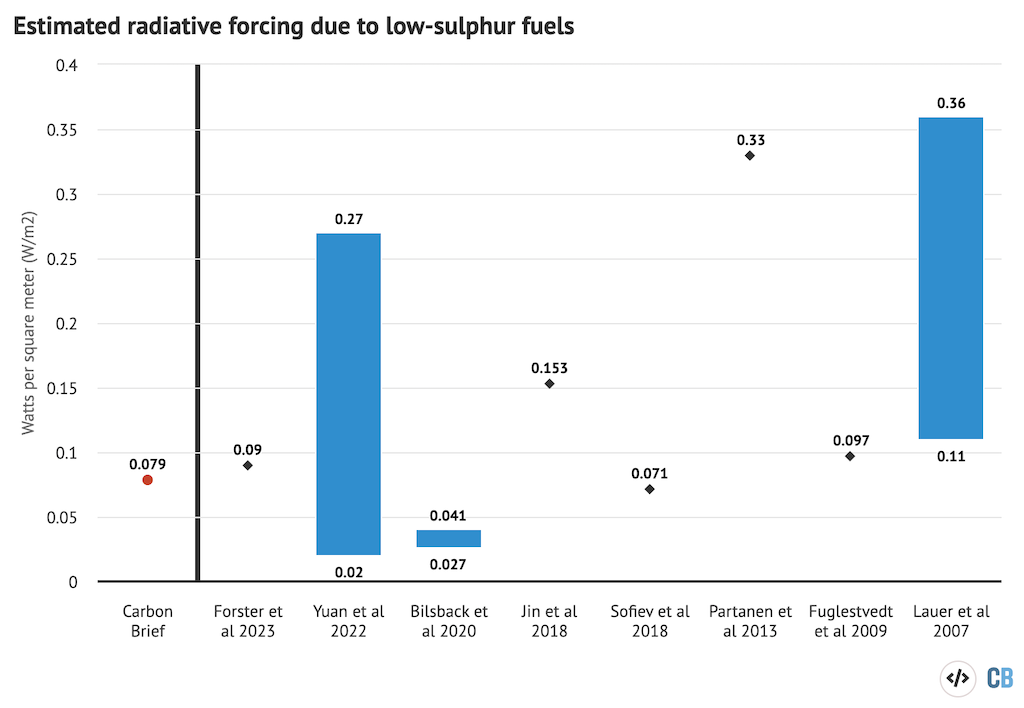

The results of the comparison suggest that the reduction in SO2 emissions as a result of the 2020 regulations requiring low-sulphur marine fuel increases radiative forcing by 0.079 watts per square metre across Earth’s surface.

This estimate is reasonably well in-line with – though on the lower end of – a number of other published studies that have assessed the likely climate impact of marine low-sulphur fuel.

The figure below shows Carbon Brief’s estimate on the left hand side compared with eight different studies published over the past two decades.

It is possible that the increase in forcing over the oceans might be larger than predicted by FaIR, as those regions have lower aerosol concentrations and, thus, larger sulphur effects on cloud formation per unit of emissions. However, as mentioned earlier, oceans have larger background levels of sulphur from natural dimethyl sulphide emissions than land regions.

Warming boost

The next step in working out the climate impact of low-sulphur regulations for marine fuel is to translate the change in radiative forcing into warming.

This analysis uses a version of FaIR designed to emulate an ensemble of 66 of the latest generation models from the Coupled Model Intercomparison Project ( CMIP6 ).

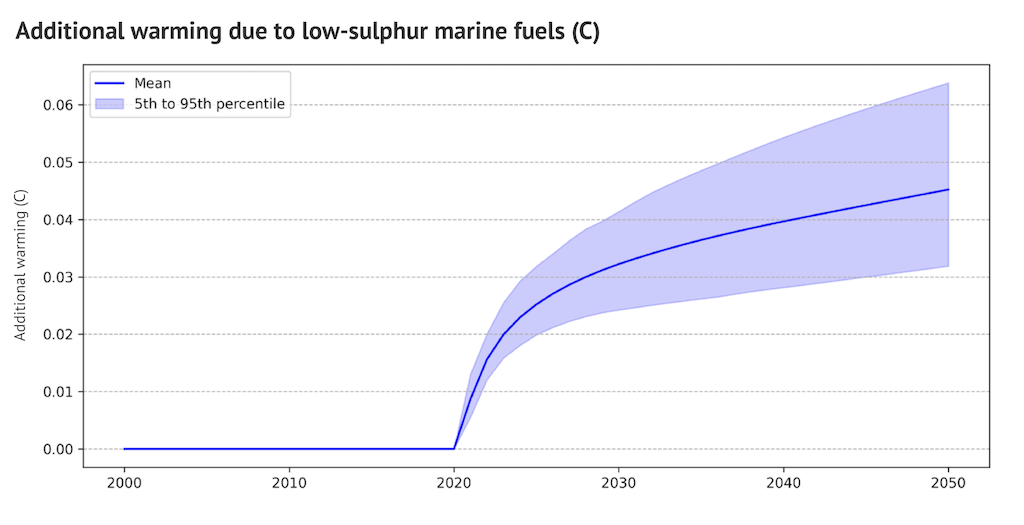

The figure below shows the resulting warming, including the mean (blue line) and 5th/95th percentile (blue shading). The central estimate is around 0.045C warming after 30 years.

An analysis in 2009 estimated that a 90% decline in marine SO2 emissions would result in around 0.05C of additional warming, with a rapid climate response in the first 15 years. This is similar to Carbon Brief’s central estimate of around 0.045C warming after 30 years.

The effects of lower SO2 emissions on the climate are not instantaneous, as it takes some time for the Earth system to respond to a change in forcing. About half of the response to a change in forcing is experienced in the first four years, while the remainder occurs more slowly.

In the case of SO2 emissions over the ocean, the response may be even slower than simulated in the FaIR model due to faster equilibration of temperatures over land than over the ocean.

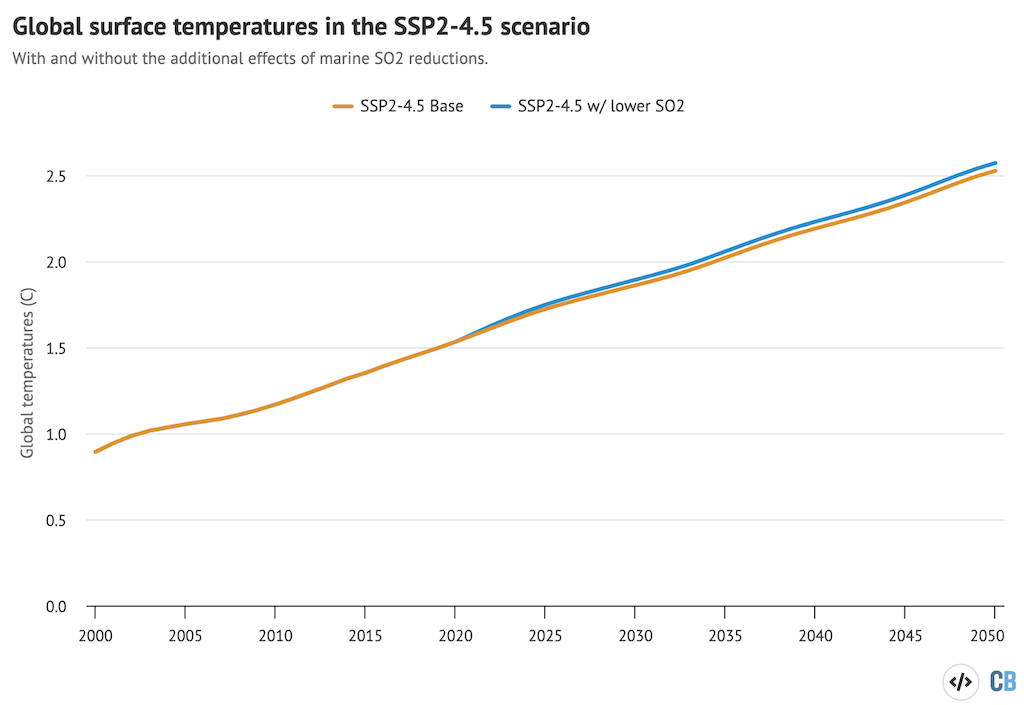

The figure below shows Carbon Brief’s estimate of overall warming by 2050 with the IMO restrictions on sulphur content in marine fuel (blue) compared to with no regulations (orange).

The SSP2-4.5 scenario is comparable to what is expected under policies in place today and assumes only a modest reduction in future SO2 emissions (compared to deep mitigation scenarios which assume much deeper reductions).

Carbon Brief’s analysis suggests that the additional warming due to the IMO regulations on marine fuel is approximately equivalent to two additional years of global greenhouse gas emissions from human activity at their current rate. While this does not fundamentally change where the world is headed in terms of warming by 2050, it does make it more difficult to limit warming to 1.5C over the next few decades.

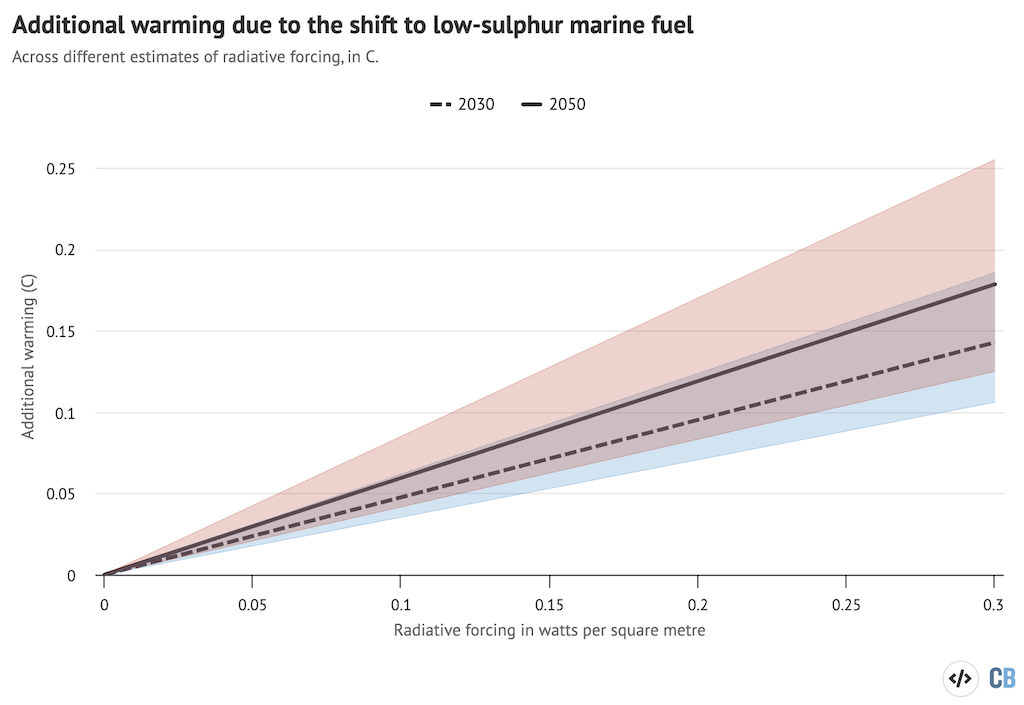

However, the change in radiative forcing due to a drop in SO2 emissions remains highly uncertain, especially over the oceans. The figure below shows the projected warming in 2030 and 2050 for a variety of forcing estimates found in the literature.

Taking the high end of the range of estimates of radiative forcing could result in up to 0.18C additional warming by 2030 and 0.25C additional warming by 2050, though most studies have found lower forcing estimates than this.

Contributing factor

Given that there will be a lagged response from the climate to the shift to low-sulphur marine fuel, it is reasonable to expect less than half of the warming resulting from the 2020 regulations to have materialised by 2023, likely only in the hundredths of a degree globally.

This is unlikely to be sufficient to explain the spike in global sea surface temperature in recent weeks, which is around 0.2C above the prior record for this time of year.

Rather, there are a number of other factors likely contributing to current record-warm ocean temperatures. These include the end of a moderate La Niña event at the start of the year and a developing El Niño , a shift which tends to result in higher global temperatures.

Stratospheric water vapour from the 2022 eruption of the Hunga Tonga-Hunga Ha’apai volcano and an unusual absence of dust from the Sahara Desert over the tropical North Atlantic may also be helping drive the ocean heatwave.

In summary, the primary driver of climate change remains CO2 emissions from fossil fuels. The shift to low-sulphur marine fuel triggered by clean air regulations may increase the warming we experience in the near future, but it will not change our long-term trajectory of around 2.6C of warming by the end of the century.

Q&A: Why methane levels are rising with no ‘hint of a decline’

Guest post: Why resolving how land emissions are counted is critical for tracking climate progress

Tonga volcano eruption raises ‘imminent’ risk of temporary 1.5C breach

‘Top 1%’ of emitters caused almost a quarter of growth in global emissions since 1990

Expert analysis direct to your inbox.

Get a round-up of all the important articles and papers selected by Carbon Brief by email. Find out more about our newsletters here .

Advertisement

IMAGES

VIDEO

COMMENTS

Providing yacht fuel supplies since 1990, Global Yacht Fuel is one of the industry's top and most trusted suppliers of yacht fuel and lubricants. Our mission is to build long-term relationships that best serve your needs and timetables. We work diligently to offer you the best prices and a hastle-free experience.

World Fuel Services, Yacht Solutions are a proud sponsor of SeaKeepers Society who promote oceanographic research, conservation and education through direct involvement with the yachting community. Focus on the journey, and leave the fuel and lubricant to World Fuel Services. 24/7 elite support available wherever you are.

A list of the ports of call that we serve for fuel of yachts, superyachts, marine transportation, boats, docking for fuel around the world at these ports of call. 0.

At Global Yacht Fuel we have been arranging fuel supplies exclusively for yachts since 1990 and are considered one of the industry's top and most trusted suppliers. It is our goal to achieve long-term relationships with our clients. No one will work as hard to ensure that your experience a trouble-free delivery at the best price.

West Nautical's Vessel Manager, Tony Hildrew, a former Yacht Chief Engineer said: "Fuel is the single biggest expense when it comes to yacht operations, it is estimated that the global spend on fuel is around $150bn annually however this shouldn't put you off, there are a number of ways to ensure your fuel consumption doesn't get out of ...

In 2020, the global limit on sulfur content for all marine fuels will be lowered dramatically, sending shockwaves through global refined-product markets while widening margins and differentials. Most refiners are still trying to come to grips with the potential threats and opportunities that will emerge as a result of this regulation.

Global Yacht Fuel is dedicated to the support of the world traveling mega-yacht. As a leader in the yacht fuel industry for over 20 years we take pride in the care and service we provide to ensure trouble free delivery and earn your trust. By focusing on the organization and execution of fuel to the yachts, we have developed a worldwide network ...

Global Yacht Fuel is a reputable fuel supplier based in Fort Lauderdale, FL, catering to the marine industry. Specializing in providing high-quality fuel for yachts and boats, the company offers reliable and efficient fueling services for marine vessels of all sizes. Generated from their business information

Revolution Fuel supply and deliver marine fuel and lubricants to superyachts and luxury yachts at over 1000 international ports and marinas around the world. Products. ... individualised and tailored global service. [email protected] Call me on +44 7554 534 317 Message me on WhatsApp.

The Future of Maritime Fuels. The recent International Maritime Organization (IMO) Marine Environment Protection Committee has set new greenhouse gas (GHG) emissions reduction goals for the shipping industry, which will lead the sector to switch from conventional fuels to zero or near zero GHG fuels by 2050. In view of the maritime sector's ...

World Fuel Services strengthens commitment to industry collaboration with key CIMAC appointment. May 30, 2024 - Miami - World Fuel Services (World Fuel) announces that John Stirling, the company's Director, Marine Technical, has accepted a key position at CIMAC, the International Council on Power, Drives and Propulsion.

GLOBAL YACHT FUEL, LLC is an Active company incorporated on April 13, 2007 with the registered number M07000002165. This Foreign Limited Liability company is located at 5353 E. PRINCESS ANNE ROAD, STE. E, NORFOLK, VA, 23502, US and has been running for seventeen years. It currently has one Manager.

Pioneering next wave fuel solutions. We are Dan-Bunkering, a global leader in fuel solutions for the maritime industry. With more than 40 years of experience, 90 international fuel suppliers across 11 offices, we're committed to pioneering the next wave of fuel solutions together with our customers and partners. About us.

Over the years, the marine fuel sector has experienced significant advancements, driven by a growing need for sustainability and efficiency. At Peninsula, we are at the forefront of these advancements,... Marine Energy Services and Solutions with Peninsula. With over 25 years of expertise, at Peninsula, we have established ourselves as a global ...

Global Marine Fuel Trends 2030 from Lloyd's Register and University College London's Energy Institute explores the drivers for the future energy mix in shipping in 2030. The report provides insight into future fuel demand for the containership, bulk carrier/general cargo and tanker sectors - representing approximately 70% of the global ...

Diesel-electric. ABB Marine & Ports, which has already fitted several Azipod-driven superyachts, including Luminosity and the 80-metre Nobiskrug Artefact, has recently struck an agreement with Ballard Power Systems to speed the development of fuel cell-based solutions for the maritime industry.

Global Yacht Fuel; Our Customers; News; Ground Fuels. Atlantic Coast Energy LLC Comprehensive hauling and direct delivery of a variety of fuels in Southeastern, PA. ISObunkers LLC (PA division) Facilitates transport and sales of fuel to various municipal entities in the PA, NJ, MD, DE and NY areas.

The rapid phaseout of sulphur in marine fuels likely reduced global SO2 emissions from marine fuels by around 8.5MtSO2 per year, to around 2.5 MtSO2 per year. This represents an abrupt decline in global SO2 emissions of around 10% after 2020. Global SO2 emissions from international shipping from the global aerosol dataset (CEDS) (1970-2019).

Get more information for Global Yacht Fuel Inc in Fort Lauderdale, FL. See reviews, map, get the address, and find directions.

It is projected that blue and e-ammonia will capture between 20% to 60% of total shipping fuels by 2050, with total consumption by shipping increasing on average from 0.79 exajoules (EJ) in 2030 to 6.06 EJ in 2050. In the biofuels scenarios, liquefied bio-methane is projected to capture on average 34% of total shipping fuels by 2050, with total ...